Can You Really Trust Instant Online Home Values? Expert CMA Tips

Instant online home values can miss the mark by tens of thousands. Discover why local expertise and a free CMA from a trusted agent give you real accuracy.

Instant online home values can miss the mark by tens of thousands. Discover why local expertise and a free CMA from a trusted agent give you real accuracy.

Learn how to spot the best long term rental properties. Use our Investors Checklist to analyze cash flow, location, and ROI before you buy. And be a successful landlord.

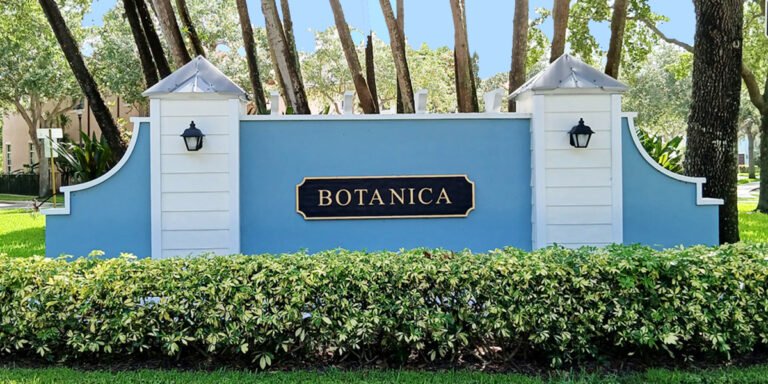

Botanica, Jupiter, Florida’s Hidden Gem, was built between 2004 and 2015 by Centex and Ecclestone Signature Homes and consists of 3 neighborhoods: Sandpiper Cove, Strathmoor, and Estates.

The Top Home Design Trends for 2022 are represented in the above photo. Key words: warm, inviting, minimalist, back to nature, rounded, earth tones, variety of textures. These design trends will be covered in this article.

This 7 strategy article presents expert advice and practical solutions to navigate Florida’s evolving insurance landscape, empowering homeowners to secure comprehensive coverage without breaking the bank.

Investing in real estate has long been one of Americans’ favorite ways to grow their wealth. Read the Pros & Cons of Being a Landlord with Income from rental Properties.

My Home Didn’t Sell… Now What? We’ve outlined the top five reasons a home doesn’t sell—and action steps you can take to overcome each of these issues.

Several articles have been released concerning home design trends in 2023. We have chosen ten of these designs that you could try, as a do-it-yourself project, to update your property this year.

If you’re a homeowner, it’s important for you to understand how your home’s value contributes to your overall net worth.

However, for some renters, rising home prices are making dreams of homeownership feel further out of reach. If you’re a renter, now is the time for you to figure out how home ownership fits into your short-term goals and your long-term financial future. An investment in real estate can help you grow your net worth.