*2024 Real Estate Market Reports Palm Beach County Florida

Palm Beach County Market Reports’ Summary of Single Family Homes and Condos in this month 2024 with Stats and SOLD Housing Trends. Buying or Selling, Text/ Call 561-339-1779 to set-up FREE Consultation.

Top 4 Factors to Consider When Choosing Your Mortgage

The key to finding the right home loan for you is to look for one that you’ll feel comfortable with long after you’ve closed on your new property. In addition to comparing term lengths and mortgage rates, also consider how the loan will fit your daily life and preferences.

Florida Back to School Sales Tax Holiday for Florida July 29 – August 11, 2024

Florida’s Back to School Sales Tax Holiday begins Monday, July 29, 2024, which means shoppers won’t pay sales tax on most of the things found on a student’s supply list! Sales Tax Holiday ends August 11, 2024.

Mid-Year Real Estate Market Update 2024

Mid-Year Real Estate Market Update 2024 What Buyers and Sellers Need to Know Time for a mid-year real estate market update in 2024. Read on for our take on this year’s most important real estate news and get a sneak peek into what analysts predict is around the corner for 2024. First A Review Last December, when the Federal Reserve projected a series of benchmark rate cuts in the coming year, some analysts speculated that mortgage rates—which had recently peaked near 8%—would fall closer to 6% by mid-2024.1,2,3 Unfortunately, persistent inflation has delayed the central bank’s timeline and kept the average 30-year mortgage rate hovering around 7% so far this year.2 While elevated mortgage rates have continued to dampen the pace of home sales and affordability, there have been some positive developments for frustrated homebuyers. Nationwide, the inventory shortage is starting to ease, and an uptick in starter homes coming on the market has helped to slow the median home price growth rate, presenting some relief to cash-strapped buyers.4 There are also signs that sellers are adjusting to the higher rate environment, as a growing number list their properties for sale.4 Still, economists say a persistent housing deficit—combined with tighter lending standards and historically high levels of home equity—will help keep the market stable.5 What does it mean for you? Read to get the info you need as buyers and sellers. Mortgage Rate Cuts Will Take Longer Than Expected At its most recent meeting on May 1, the Federal Reserve announced that it would keep its overnight rate at a 23-year high in response to the latest, still-elevated inflation numbers.6 While mortgage rates aren’t directly tied to the federal funds rate, they do tend to move in tandem. So, while expected, the Fed’s announcement was further proof that a meaningful decline in mortgage rates—and a subsequent real estate market rebound—is farther off than many experts predicted. “The housing market has always been interest rate sensitive. When rates go up, we tend to see less activity,” explained Realtor.com chief economist Danielle Hale in a recent article. “The housing market is even more rate sensitive now because many people are locked into low mortgage rates and because first-time buyers are really stretched by high prices and borrowing costs.”7 Many experts now speculate that the first benchmark rate cut will come no sooner than September, so homebuyers hoping for a cheaper mortgage will have to remain patient. “We’re not likely to see mortgage rates decline significantly until after the Fed makes its first cut; and the longer it takes for that to happen, the less likely it is that we’ll see rates much below 6.5% by the end of the year,” predicted Rick Sharga, CEO at CJ Patrick Company, in a May interview.8 What does it mean for you? Mortgage rates aren’t expected to fall significantly any time soon, but that doesn’t necessarily mean you should wait to buy a home. A drop in rates could lead to a spike in home prices if pent-up demand sends a flood of homebuyers back into the market. Reach out to schedule a free consultation so we can help you chart the best course for your home purchase or sale. BUYERS ARE GAINING OPTIONS AS SELLERS RETURN TO THE MARKET There is a silver lining for buyers who have struggled to find the right property: More Americans are sticking a for-sale in their yard.9 Given the record-low inventory levels of the past few years, this presents an opportunity for buyers to find a place they love—and potentially score a better deal. In 2023, inventory remained scarce as homeowners who felt beholden to their existing mortgage rates delayed their plans to sell. However, a recent survey by Realtor.com shows that a growing number of those owners are ready to jump in off the sidelines.10 While the majority of potential sellers still report feeling “locked in” by their current mortgage, the share has declined slightly (79% now versus 82% in 2023). Additionally, nearly one-third of those “locked-in” owners say they need to sell soon for personal reasons, and the vast majority (86%) report that they’ve already been thinking about selling for more than a year.10 Renewed optimism may also be playing a part. “Both our ‘good time to buy’ and ‘good time to sell’ measures continued their slow upward drift this month,” noted Fannie Mae Chief Economist Doug Duncan in an April statement.11 However, the current stock of available homes still falls short of pre-pandemic levels, according to economists at Realtor.com. “For the first four months of this year, the inventory of homes actively for sale was at its highest level since 2020. However, while inventory this April is much improved compared with the previous three years, it is still down 35.9% compared with typical 2017 to 2019 levels.”4 What does it mean for you? If you’ve had trouble finding a home in the past, you may want to take another look. An increase in inventory, coupled with relatively low buyer competition, could make this an ideal time to make a move. Reach out if you’re ready to search for your next home. If you’re hoping to sell this year, you may also want to act now. If inventory levels grow, it will become more challenging for your home to stand out. We can craft a plan to maximize your profits, starting with a professional assessment of your home’s current market value. Contact us to schedule a free consultation. HOME PRICES ARE RISING AT A MORE MANAGEABLE PACE Homebuyers struggling with high borrowing costs have something else to celebrate. The national median home price has remained relatively stable over the past year, due to sellers bringing a greater share of smaller, more affordable homes to the market.4 In addition to offering cheaper homes, a recent survey found that home sellers are also adjusting their expectations when it comes to pricing. In many regions, just 12% anticipate a bidding war (down from 23% last year) and only 15% expect to sell above list

10 Pro Tips for a Smooth Home Move

Whatever your circumstances, the road to the closing table can be riddled with obstacles — from issues with showings and negotiations to inspection surprises. But many of these complications are avoidable.

Save Money on Florida Home Insurance

This 7 strategy article presents expert advice and practical solutions to navigate Florida’s evolving insurance landscape, empowering homeowners to secure comprehensive coverage without breaking the bank.

Palm Beach Gardens Report Real Estate Market

Palm Beach Gardens report of current real estate trends is slightly in a sellers’ market. The Martin Group of Realtors® can help you sell or buy a property. Text or call our office: 561-339-1779 for more info.

Downsize Your Home To Optimize Your Life

Downsize your home to optimize your life. It may be time to trade unused square footage for a smaller, more manageable space. Included are tips to make this adjustment much easier for you.

Real Estate Market Forecast: Opportunities for Home Buyers and Sellers in 2024

Real Estate Market Forecast: Trends for this year show many opportunities for home buyers and sellers in 2024. Look for interest rates and the number of houses listed to change.

An Eco-Friendly Holiday at Home

Check out our ideas for an Eco-friendly holiday at home with 5 iIdeas to celebrate Sustainably this year during the holidays. Its the most wonderful time of the year, and yet its also the most wasteful.

How To Stretch Your Holiday Budget in Season of Inflation

You don’t have to break the bank to celebrate the holidays in style—even in this season of inflation. Prices may be higher on everything, but there are still plenty of opportunities to stretch your holiday budget and find extra savings.

Investing in Real Estate As a Landlord

Investing in real estate has long been one of Americans’ favorite ways to grow their wealth. Read the Pros & Cons of Being a Landlord with Income from rental Properties.

My Home Didn’t Sell… Now What?

My Home Didn’t Sell… Now What? We’ve outlined the top five reasons a home doesn’t sell—and action steps you can take to overcome each of these issues.

10 Tips to Attract the Best Offers for Your Home

Several articles have been released concerning home design trends in 2023. We have chosen ten of these designs that you could try, as a do-it-yourself project, to update your property this year.

How to Avoid Home Buyer’s Remorse

Several articles have been released concerning home design trends in 2023. We have chosen ten of these designs that you could try, as a do-it-yourself project, to update your property this year.

Renovate or Relocate? Tips To Help You Decide

Does your current home no longer serve your needs? Should you renovate or relocate?

Home Sellers: How to Get the Highest Price For My Home

In this article are some tips to get the highest price when selling your home. It is all about preparation, pricing, and promotion to get the top dollar for your home.

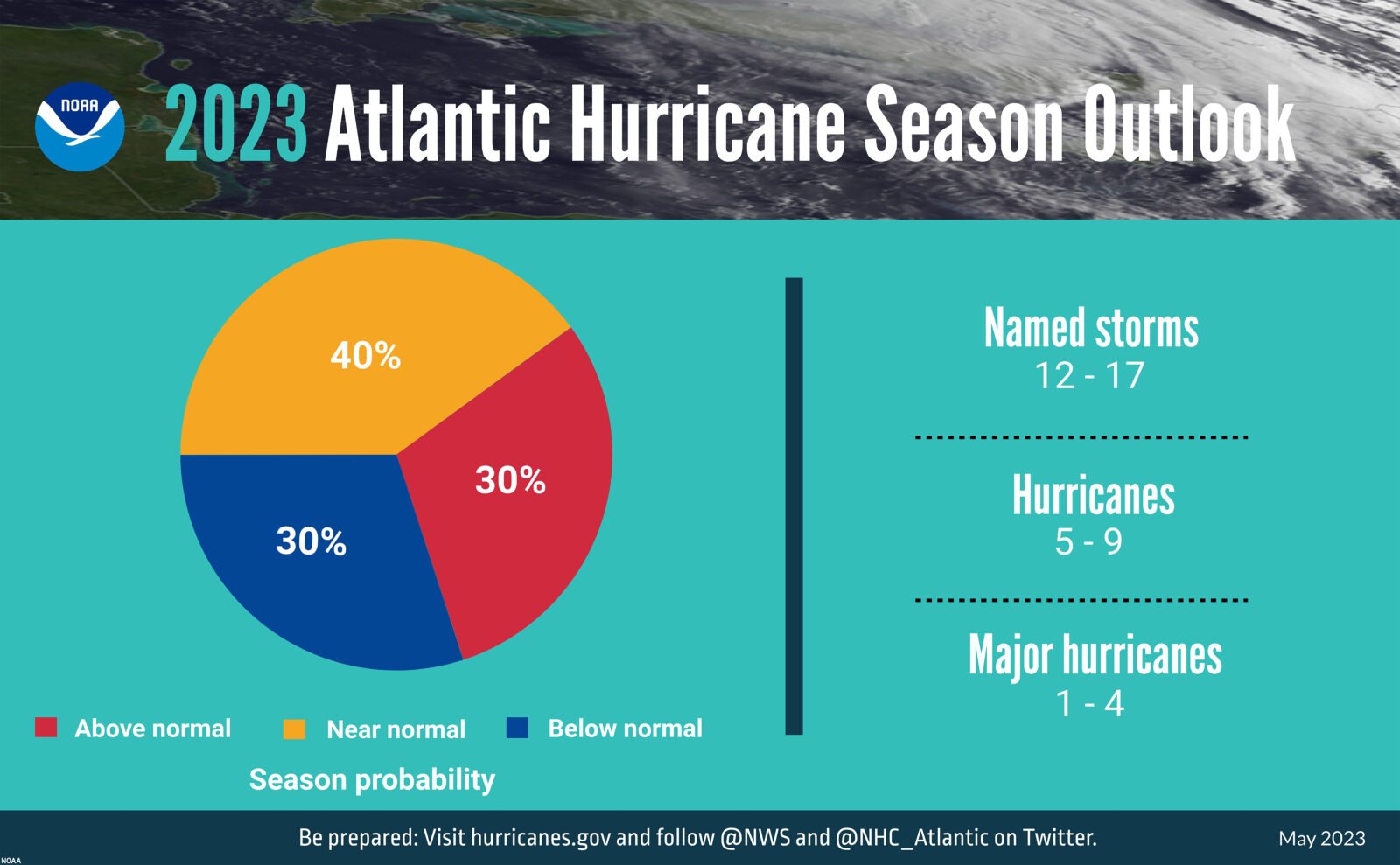

Florida Hurricane Preparations Checklist 2023

Hurricane Season starts June 1 & goes through November 30, 2021, and is predicted to be about average with number of storms. Be Prepared with these Check Lists & Tips.

First Time Home Buyers: How to Budget For a House

It’s not easy being a first time home buyer right now. At the end of last year, housing affordability hit an all-time low. Here are some workarounds to consider as you plot your first home purchase.

Stress-Free House Cleaning: 30 Practical Tips for Busy Households

House cleaning and keeping an orderly home is a challenge for many of us. Between busy work schedules, social obligations, and family commitments, it’s tough to keep up with daily chores—let alone larger seasonal tasks. The effort is worthwhile!

Selling Your Home: Sellers Checklist

If you want to maximize your sale price, it’s still important to prepare your home before putting it on the market. We have included a check list for your convenience.

10 Home Design Trends to Try In 2023

Several articles have been released concerning home design trends in 2023. We have chosen ten of these designs that you could try, as a do-it-yourself project, to update your property this year.

10 Tips for First Time Home Buyers

Making the leap from renter to first-time home buyer can be a daunting process. With so many steps and decisions to make, it can seem overwhelming at times. But it doesn’t have to be!

With the right guidance and preparation, you can make the leap from renter to first-time home buyer smoothly and successfully. In this article, we’ll offer our top 10 tips for first-time home buyers so you can make the transition without any hiccups.

Free Admission Days To Recreation In Florida

National Parks that typically charge an entrance fee will waive it on special days of each year, providing free admission to everyone on the following fives days listed below in 2023.

Annual Real Estate Market Report Palm Beach County Florida

Single Family Homes and Condos in Palm Beach County Summary Reports Year-end Annual 2022 with Stats and SOLD Housing Trends. Buying or Selling, Text/ Call 561-339-1779 to set-up FREE Consultation.

2023 Florida Housing Market Forecast What It Means For You

You don’t have to break the bank to celebrate the holidays in style—even in this season of inflation. Prices may be higher on everything, but there are still plenty of opportunities to stretch your budget and find extra savings.

Sellers: How to Get Highest Price For My Home

In this article are some tips to get the highest price when selling your home. It is all about preparation, pricing, and promotion to get the top dollar for your home.

Annual Vs Seasonal Rentals What’s the Difference?

Are you thinking about renting a house or condo, but you’re not sure whether you want an annual rental, a seasonal rental, or just a short vacation rental? There are pros and cons to all types of leases.

Real Estate CMA: Comparative Market Analysis

Know the factors that affect market or home value which are different from assessed value, which is often lower than the market value. Martin Group can help you with both numbers. Text or Call at 561-3391-779 to schedule your free consultation.

Florida Tool Time Sales Tax Holiday September 2022

Florida’s tool time sales tax holiday begins September 2, 2023, which means shoppers won’t pay sales tax on most of the things found on the tool time list! The Tool Time Sales Tax Holiday ends September 8, 2023.