Why Florida Interest Rates Matter Now More Than Ever For Home Buyers in 2025

Florida Interest Rates in 2025: How They Impact Home Buyers, Sellers & Investors

Discover why Florida interest rates play a critical role in Florida’s housing market in 2025. Rising rates affect home prices, buyer demand, and local markets like Jupiter, Palm Beach Gardens, and West Palm Beach.

An interest rate is the cost of borrowing money from a lender. In real estate, this translates into your mortgage rate—the percentage applied to your loan balance that determines your monthly payment.

Interest rates are a foundational component of the economy because they influence the cost of borrowing and the incentive to save, thereby impacting decisions for consumers, businesses, and investors.

Central banks, like the U.S. Federal Reserve, use interest rates as a primary tool of monetary policy to manage economic growth and control inflation.

Even small rate changes can make a big difference. For example:

- On a $500,000 mortgage, a 1% rate increase can raise monthly payments by over $300.

- Over 30 years, that’s more than $100,000 in additional costs.

- This is why buyers watch rates so closely.

The Current Mortgage Rate Environment (2025 Update)

- Average 30-Year Fixed Rate: about 6.26%

- Average 15-Year Fixed Rate: about 5.41%

- Average 5/1 ARM (Adjustable Rate): about 6.0%

While these figures are higher than pandemic lows (under 3%), they are still considered moderate compared to past decades when rates exceeded 10% to above 18%.

If you want to see how much difference mortgage rates and the size of your down payment make, go to the Mortgage Calculator and play with the numbers.

A Brief History of U.S. Interest Rates

Interest rates rise and fall with the economy, inflation, and Federal Reserve policy:

- 1980s: Mortgage rates spiked above 18% to fight runaway inflation.

- 1990s: Rates settled into a more manageable 5%–10% range.

- 2000s: Dot-com crash & 9/11 → rates cut low. Housing bubble mid-2000s.

- 2008–2015: Great Recession → near-zero rates for years.

- 2016–2019: Slow hikes back to about 2%–3%.

- 2020–2021: COVID shock → emergency cuts to 0%.

- 2022–2023: Inflation surge → Fed raised rates rapidly to cool the economy.

- 2024–2025: Inflation easing, but Fed funds still about 4.25–4.5%.

- Sept 2025: Feds lowered rates about 4.0%-4.25% for weakening labor market & slower economic growth.

At the October, 2025 meeting, the U.S. Federal Reserve lowered its key interest rate by a quarter-percentage point (0.25%) to a range of 3.75% to 4.00%. This was the first reduction since September, 2025 and was done in response to signs of a weakening labor market, with the Fed signaling the potential for further cuts later in the year.

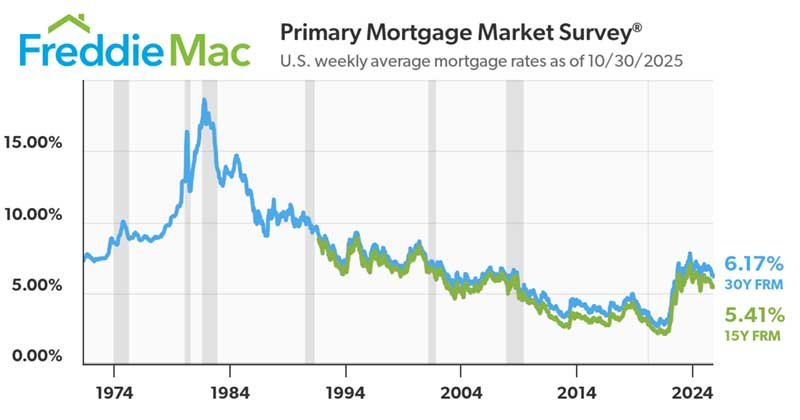

Historical Primary Mortgage Rates by Freddie Mac

Freddie Mac Historical Mortgage Rate Averages at Closing on Sept 18, 2025

Freddie Mac Historical Mortgage Rate Averages at Closing on Sept 18, 2025

See the Current Mortgage Rates at Freddie Mac

How Interest Rates Affect Buyers:

For buyers, interest rates determine affordability.

Higher Rates:

- Reduce purchasing power (you qualify for a lower loan amount)

- Increase monthly payments

- Create hesitation, causing some buyers to wait for a rate drop

However, buyers who act during higher-rate periods may face less competition and more negotiating power.

How Interest Rates Affect Sellers:

For sellers, higher rates can:

- Shrink the pool of qualified buyers

- Extend days on market

- Pressure sellers to adjust pricing

That said, in desirable Florida locations, limited inventory continues to support strong prices, even with fewer buyers.

How Interest Rates Affect Investors

Investors must weigh borrowing costs against rental income. In 2025, rental demand remains strong in Palm Beach County, helping offset higher financing costs. Many investors are shifting toward cash purchases to avoid rate impacts.

Comparing Local Real Estate Markets: Jupiter, Palm Beach Gardens, and West Palm Beach

Interest rates affect every market differently. Let’s examine three key Palm Beach County cities.

Jupiter:

- Lifestyle-Driven Demand

- Median Price: (2025): $875,000

- Buyer Pool: Families, retirees, second-home buyers

- Market Note: Luxury demand for waterfront and golf course properties keeps Jupiter strong.

Palm Beach Gardens:

- Balanced Growth

- Median Price: (2025): $725,000

- Buyer Pool: Professionals, golfers, seasonal residents

- Market Note: Biotech growth and amenities create resilience, even as borrowing costs rise.

West Palm Beach:

- Affordability Meets Energy

- Median Price: (2025): $525,000

- Buyer Pool: Young professionals, first-time buyers, investors

- Market Note: More sensitive to interest rates, but supported by affordability and downtown expansion.

Local Market Comparison Table: Jupiter, Palm Beach Gardens, West Palm Beach

| City | Median Home Price (2025) | Key Buyer Pool | Market Insights |

|---|---|---|---|

| Jupiter | $875,000 | Families, second-home buyers, retirees | Strong luxury demand; limited supply keeps prices steady. |

| Palm Beach Gardens | $725,000 | Professionals, golfers, seasonal residents | Balanced growth; biotech corridor supports stability. |

| West Palm Beach | $525,000 | Young professionals, first-time buyers, investors | More rate-sensitive; affordability drives demand. |

Step 1: Check Median Home Prices

Jupiter’s median home price sits around $875,000, Palm Beach Gardens about $725,000, and West Palm Beach $525,000. Prices provide the foundation for affordability.

Step 2: Identify Buyer Demographics

Jupiter draws luxury buyers and families, Palm Beach Gardens balances professionals and retirees, and West Palm Beach attracts first-time buyers and investors.

Step 3: Analyze Market Resilience

Jupiter’s limited inventory shields it, Palm Beach Gardens benefits from job growth, while West Palm Beach reacts more to rate changes.

Step 4: Decide Based on Priorities

Choose Jupiter for luxury, Palm Beach Gardens for balance, and West Palm Beach for affordability and urban vibrancy.

Conclusion: Navigating Interest Rates in 2025

Interest rates will continue to influence buying power, but they don’t have to stop your real estate goals. By understanding the dynamics of each market—Jupiter’s lifestyle-driven demand, Palm Beach Gardens’ balance of growth, and West Palm Beach’s affordability—you can make smarter decisions in any rate environment.

For personalized guidance, connect with us, your trusted local real estate professionals, who understand both the numbers and the neighborhoods.

Ready to Buy, Sell, or Invest in Real Estate?

Let’s Chat!

The Martin Group of Realtors®

LOCAL EXPERTISE • GLOBAL REACH

50+ years of experience as Realtors® and Custom Home Builders.

Helping you reach your real estate goals!

Jason Martin & Doug Martin

Premier Brokers International

Jason Martin, PA

Residential Realtor® Agent

561-624-4544

Email Me

Doug Martin

Broker Realtor® Emeritus

561-339-3299

Email Me