Florida Condo Market Trends Since Miami Surfside Collapse

Florida Condo Market Trends Since Miami Surfside Towers Collapse

Discover how the Florida condo market has changed since the Surfside collapse in Miami—safety laws, prices, insurance, and Palm Beach County oceanfront condo updates.

Introduction

The tragic Champlain Towers South in Surfside, FL condo collapse in June 2021 was a wake-up call for Florida and the nation. In just seconds, 98 lives were lost and confidence in high-rise living was shaken. What had once been considered a carefree lifestyle—ocean views, amenities, and maintenance-free living—suddenly came with new questions about safety, costs, and long-term sustainability.

In the years since, the Florida condo market has undergone dramatic changes. Prices, insurance, regulations, and buyer expectations have all shifted.

This comprehensive report explores the condition of the Florida condo market post-Surfside, with a special focus on Palm Beach County’s oceanfront communities. Whether you’re a condo owner, prospective buyer, or real estate investor, this guide will help you understand the challenges and opportunities in today’s market.

How the Surfside Collapse Changed Florida’s Condo Market

The Surfside tragedy instantly altered perceptions of condo ownership. Once seen as an easy way to enjoy Florida’s lifestyle, condos are now viewed through the lens of safety and financial risk.

Buyers became cautious, asking for inspection records, engineering reports, and reserve fund details before signing contracts.

Condo associations faced pressure to prove their buildings were structurally sound and financially prepared for future repairs.

Market sentiment shifted, with some older high-rise buildings losing value as buyers turned to newer construction with stronger building codes.

Surfside didn’t just impact one community—it reshaped how the entire state views condos.

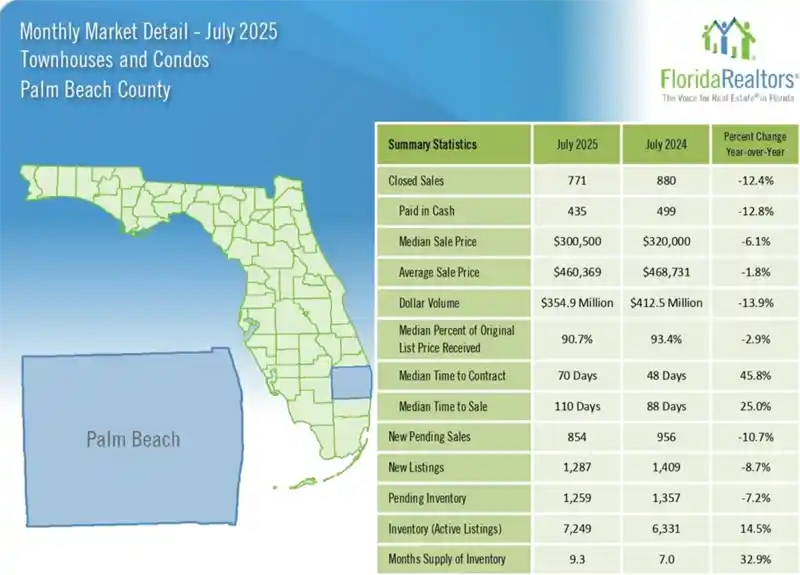

Palm Beach County Market Report August 23, 2025 With July 2025 Stats. Next report: Sept 24, 2025.

Palm Beach County Market Report August 23, 2025 With July 2025 Stats. Next report: Sept 24, 2025.

Florida Condo Market Data & Statistics

While real estate in Florida overall has remained strong, condos show a mixed picture post-Surfside:

Sales Volume: Condo sales in Miami-Dade and Broward dropped nearly 20% in the 12 months following Surfside. Palm Beach County remained more stable but still saw reduced demand for older oceanfront towers.

Prices: Median condo prices in Florida rose 8% from 2021 to 2023, but appreciation slowed in older high-rises requiring expensive repairs.

Days on Market: Older condos now take significantly longer to sell compared to new construction. In 2024, listings for pre-1980 buildings stayed on the market an average of 65 days, vs. 32 days for newer units.

Newer Construction: Realtors® are seeing increased demand for luxury high-rises built after 2005, which comply with stricter hurricane and structural standards.

New Safety Regulations and Building Code Changes

Following Surfside, Florida lawmakers passed Senate Bill 4-D in 2022, one of the most significant condo reforms in state history.

Key provisions include:

Mandatory Milestone Inspections: Condos over three stories and older than 30 years (25 years if within 3 miles of the coast) must undergo structural inspections by licensed engineers.

10-Year Re-Inspections: After the initial milestone inspection, condos must be re-inspected every 10 years.

Reserve Studies & Funding: Condo associations must conduct reserve studies and fully fund reserves for structural repairs by 2025—ending the practice of waiving reserves.

Transparency: Inspection reports must be shared with residents and prospective buyers.

These changes are creating financial challenges for associations, but are also restoring some buyer confidence.

Condo Association Board Meeting Discussion About Florida Market Trends, Insurance, and Finances

Condo Association Board Meeting Discussion About Florida Market Trends, Insurance, and Finances

Financing and Insurance Challenges

Even more than regulations, financing and insurance have become make-or-break issues for Florida condos.

Lenders: Many banks now refuse to finance condo purchases without proof of up-to-date milestone inspections and adequate reserves. Fannie Mae and Freddie Mac introduced stricter underwriting rules, making it harder for buyers to get conventional mortgages in buildings with deferred maintenance.

Insurance: Premiums have skyrocketed statewide. Condo associations in Palm Beach County report insurance hikes of 30–60% in the last two years, with some insurers exiting Florida entirely.

Special Assessments: To cover rising insurance and repair costs, many associations are levying large assessments, sometimes $50,000–$150,000 per unit.

The result? Affordability is a growing concern—even for luxury buyers.

How Condo Buyers Are Adapting Post-Surfside

Today’s condo buyers are more cautious and informed than ever. Common strategies include:

Prioritizing newer construction (built after 2005) with stricter codes and less risk of major repairs.

Demanding transparency on inspection reports and condo financials before making offers.

Hiring engineers for independent evaluations, especially in older buildings.

Budgeting for higher monthly fees, insurance, and potential special assessments.

This caution has slowed sales in older towers, and increased competition for newer units.

Impact on Condo Associations and Residents

For condo boards and residents, Surfside triggered tough decisions.

Rising Condo Fees: Many associations have doubled or tripled monthly dues to cover reserves and repairs.

Special Assessments: Large one-time payments have caused financial strain, forcing some owners to sell.

Community Tension: Boards balancing safety with affordability often face pushback from residents.

Proactive Repairs: Some buildings embraced early repairs, boosting buyer confidence and preserving property values.

Local Focus: Palm Beach County Oceanfront Condos

Palm Beach County’s oceanfront communities have taken proactive steps since Surfside. Here’s a city-by-city look:

Boca Raton: Luxury oceanfront towers like The Addison and Mizner Grand have already conducted milestone inspections, with major repair projects underway. Buyers here pay a premium for transparency.

- Boynton Beach: Oceanfront towers on A1A have seen slower sales as buyers weigh upcoming repair costs.

Delray Beach: Smaller boutique condos are facing financial pressure to comply with reserves, but new luxury projects downtown are thriving.

- Highland Beach: Several mid-rise buildings built in the 1970s–1980s have launched concrete restoration projects. Special assessments range from $50k–$100k per unit.

- Juno Beach: Mid-rise condos, many built in the 1980s–1990s, have completed or scheduled milestone inspections. Transparency here is driving stable sales.

- Jupiter: Ocean Trail and Jupiter Ocean Grande have addressed structural requirements, with ongoing concrete restoration boosting long-term confidence.

Palm Beach (Island): Older co-ops and condos along South Ocean Blvd have already undergone major repairs, and most are fully compliant with inspection laws—maintaining strong buyer interest.

Singer Island (Riviera Beach): High-rise condos like Tiara and Phoenix Towers have embarked on multimillion-dollar restoration projects. While fees are high, these efforts reassure buyers.

Overall, Palm Beach County condos are faring better than Miami’s market, thanks to proactive associations and steady buyer demand for oceanfront living.

Singer Island condos are undergoing major repair and restoration projects.

Singer Island condos are undergoing major repair and restoration projects.

Case Studies – Condos That Have Faced Challenges

Miami-Dade Example: A Surfside-area condo required owners to pay $120,000 per unit for repairs, leading to widespread sales and foreclosures.

Singer Island Example: Dunes Towers, A Singer Island tower, initiated $45 million in structural upgrades, funded through special assessments averaging $80,000 per unit. Owners accepted the costs to preserve property values.

Success Story: A Boca Raton condo association that had maintained strong reserves completed inspections with minimal issues, boosting sales and attracting confident buyers.

Long-Term Market Outlook for Florida Condos

Looking ahead, several trends are likely:

Stricter Regulation = Long-Term Stability: While short-term pain is real, stronger rules will improve safety and restore buyer trust.

Affordability Challenges: Rising fees and insurance may price out middle-class buyers, leaving the condo market more luxury-focused.

Shift in Buyer Preferences: Expect more demand for newer condos, townhomes, and single-family homes.

Foreign Investment: South Florida may see reduced foreign investor activity due to higher ownership costs.

Palm Beach County’s proactive approach may keep its condo market healthier than Miami’s over the next 5 years.

What Buyers & Owners Should Know Today

Checklist for Buyers & Owners:

Review the latest milestone inspection report.

Check the association’s reserve study and budget.

Understand upcoming special assessments.

Request a copy of the building’s insurance coverage.

Work with a local Realtor® or attorney who understands post-Surfside regulations.

- View the Market Action Index for your city of interest.

Practical Advice for Condo Owners and Buyers

- For Owners: Review your building’s inspection reports, attend board meetings, and prepare for higher costs. Download the Sellers Condo Checklist.

- For Buyers: Always request the latest inspection and reserve study before purchasing. Click the link:

Download PDF to download the PDF of the Buyers Condo Checklist file which you can print.

- For Boards: Start inspections early, communicate transparently, and explore state assistance programs.

Being proactive is the best way to protect your investment.

Conclusion

The Surfside collapse was a tragedy that reshaped the Florida condo market forever. While challenges remain—rising costs, stricter inspections, and affordability concerns—new laws are creating safer buildings and more informed buyers.

In Palm Beach County, oceanfront condo associations are stepping up to meet requirements, ensuring long-term stability and maintaining property values. The market is evolving, but Florida condos remain an attractive lifestyle choice for those who do their due diligence.

Ready to Buy, Sell, or Invest in Real Estate?

Let’s Chat!

The Martin Group of Realtors®

LOCAL EXPERTISE • GLOBAL REACH

50+ years of experience as Realtors® and Custom Home Builders.

Helping you reach your real estate goals!

Jason Martin & Doug Martin

Premier Brokers International

Jason Martin, PA

Residential Realtor® Agent

561-624-4544

Email Me

Doug Martin

Broker Realtor® Emeritus

561-339-3299

Email Me

Download PDF

Download PDF