How to Bridge the Real Estate Appraisal Gap

Today’s Real Estate Market Unlike Any Other

If you’re searching for drama, don’t limit yourself to Netflix. Instead, tune in to the real estate market, where the competition among buyers has never been fiercer. And with homes selling for record highs,1 the appraisal process—historically a standard part of a home purchase—is receiving more attention than ever.

That’s because some sellers are finding out the hard way that a strong offer can fizzle quickly when an appraisal comes in below the contract price. Traditionally, the sale of a home is contingent on a satisfactory valuation. But in a rapidly appreciating market, it can be difficult for appraisals to keep pace with rising prices.

Thus, many sellers in today’s market favor buyers who are willing to guarantee their full offer price—even if the property appraises for less. For the buyer, that could require a financial leap of faith that the home is a solid investment. It also means they may need to come up with additional cash at closing to cover the gap.

Whether you’re a buyer or a seller, it’s never been more important to understand the appraisal process and how it can be impacted by a quickly appreciating and highly competitive housing market. It’s also crucial to work with a skilled real estate agent who can guide you to a successful closing without overpaying (if you’re a buyer) or overcompensating (if you’re a seller). Find out how appraisals work—and in some cases, don’t work—in today’s unique real estate environment.

Appraisal Requirements

An appraisal is an objective assessment of a property’s market value performed by an independent authorized appraiser. Mortgage lenders require an appraisal to lower their risk of loss in the event a buyer defaults on their loan. It provides assurance that the home’s value meets or exceeds the amount being lent for its purchase.

In most cases, a licensed appraiser will analyze the property’s condition and review the value of comparable properties that have recently sold. Mortgage borrowers are usually expected to pay the cost of an appraisal. These fees are often due upfront and non-refundable.2

Appraisal requirements can vary by lender and loan type, and in today’s market in-person appraisal waivers have become much more common. Analysis of the property, the local market, and the buyer’s qualifications will determine whether the appraisal will be waived. Not all properties or buyers will qualify, and not all mortgage lenders will utilize this system.3 If you’re applying for a mortgage, be sure to ask your lender about their specific terms.

If you’re a cash buyer, you may choose—but are not obligated—to order an appraisal.

Appraisals in a Rapidly Shifting Market

An appraisal contingency is a standard inclusion in a home purchase offer. It enables the buyer to make the closing of the transaction dependent on a satisfactory appraisal wherein the value of the property is at or near the purchase price. This helps to reassure the buyer (and their lender) that they are paying fair market value for the home and allows them to cancel the contract if the appraisal is lower than expected.

Low appraisals are not common, but they are more likely to happen in a rapidly appreciating market, like the one we’re experiencing now.4 That’s because appraisers must use comparable sales (commonly referred to as comps) to determine a property’s value. These could include homes that went under contract weeks or even months ago. With home prices rising so quickly,5 today’s comps may be lagging behind the market’s current reality. Thus, the appraiser could be basing their assessment on stale data, resulting in a low valuation.

How Are Buyers and Sellers Impacted by a Low Appraisal?

When a property appraises for less than the contract price, you end up with an appraisal gap. In a more balanced market, that could be cause for a renegotiation. In today’s market, however, sellers often hold the upper hand.

That’s why some buyers are using the potential for an appraisal gap as a way to strengthen their bids. They’re proposing to take on some or all of the risk of a low appraisal by adding gap coverage or a contingency waiver to their offer.

Appraisal Gap Coverage

Buyers with some extra cash on hand may opt to add an appraisal gap coverage clause to their offer. It provides an added level of reassurance to the sellers that, in the event of a low appraisal, the buyer is willing and able to cover the gap up to a certain amount.6

For example, let’s say a home is listed for $200,000 and the buyers offer $220,000 with $10,000 in appraisal gap coverage. Now, let’s say the property appraises for $205,000. The new purchase price would be $215,000. The buyers would be responsible for paying $10,000 of that in cash directly to the seller because, in most cases, mortgage companies won’t include appraisal gap coverage in a home loan.6

Waiving The Appraisal Contingency

Some buyers with a higher risk tolerance—and the financial means—may be willing to waive the appraisal contingency altogether. However, this strategy isn’t for everyone and must be considered on a case-by-case basis.

It’s important to remember that waiving an appraisal contingency can leave a buyer vulnerable if the appraisal comes back much lower than the contract price. Without an appraisal contingency, a buyer will be obligated to cover the difference or be forced to walk away from the transaction and relinquish their earnest money deposit to the sellers.7

It’s vital that both buyers and sellers understand the benefits and risks involved with these and other competitive tactics that are becoming more commonplace in today’s market. We can help you chart the best course of action given your individual circumstances.

What To Expect as Appraisal Gaps Grow

In today’s real estate market, low inventory and high demand are driving up home prices. As many as 39% of homes are getting offers over the listing price, based on the latest Realtors Confidence Index from the National Association of Realtors (NAR). Shawn Telford, Chief Appraiser at CoreLogic, elaborates:

__________________________

“The frequency of buyers being willing to pay more

than the market data supports is increasing.”

___________________________

While this is great news for today’s sellers, it can be tricky to navigate if the price of your contract doesn’t match up with the appraisal for the house. It’s called an appraisal gap, and it’s happening more in today’s market than the norm.

According to recent data from CoreLogic, 19% of homes had their appraised value come in below the contract price in April of this year. That’s more than double the percentage in each of the two previous Aprils.

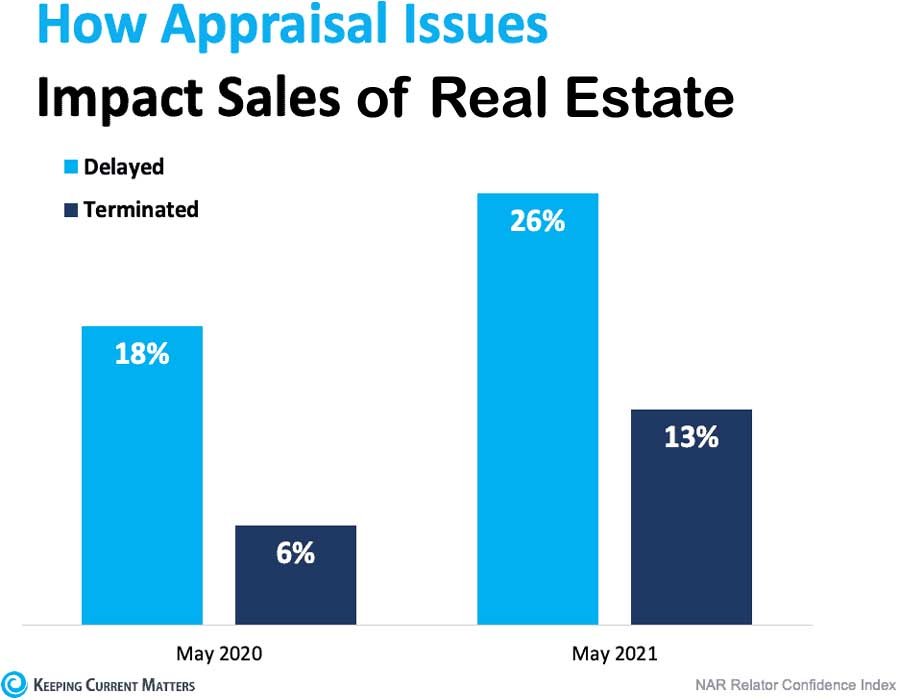

The chart below uses the latest insights from NAR’s Realtors Confidence Index to showcase how often an issue with an appraisal slowed or stalled the momentum of a house sale in May of this year compared to May of last year.

If an appraisal comes in below the contract price, the buyer’s lender won’t loan them more than the house’s appraised value. That means there’s going to be a gap between the amount of loan the buyer can secure and the contract price on the house.

In this situation, both the buyer and seller have a vested interest in making sure the sale moves forward with little to no delay. The seller will want to make sure the deal closes, and the buyer won’t want to risk losing the home. That’s why it’s common for sellers to ask the buyer to make up the difference themselves in today’s competitive market.

Don’t Waive Your Right to the Best Representation

There’s never been a market quite like this one before. That’s why you need a master negotiator on your side who has the skills, instincts, and experience to get the deal done…no matter what surprises may pop up along the way.

If you’re a buyer, we can help you compete in this unprecedented market—without getting steamrolled. And if you’re a seller, we know how to get top dollar for your home while minimizing hassle and stress.

Bottom Line

Whether you’re buying or selling, your real estate agent is your ally. They’re with you throughout the process and are there to help you navigate the unexpected, including potential appraisal gaps.

Contact the Martin Group today at

561-339-1779 to schedule a complimentary real estate consultation.

Sources:

- Wall Street Journal –

https://www.wsj.com/articles/u-s-home-prices-push-to-record-high-slowing-pace-of-purchases-11621605953 - US News & World Report – https://realestate.usnews.com/real-estate/articles/what-is-a-home-appraisal-and-who-pays-for-it

- Rocket Mortgage –

https://www.rocketmortgage.com/

learn/appraisal-waiver - Money –

https://money.com/

coronavirus-low-home-appraisal/ - S&P CoreLogic Case-Shiller 20-City Composite Home Price NSA Index –https://www.spglobal.com/

spdji/en/indices/indicators/sp-corelogic-case-shiller-20-city-composite-home-price-nsa-index/#overview - Bigger Pockets –

https://www.biggerpockets.com/

blog/appraisal-gap-coverage - Washington Post –

https://www.washingtonpost.com/

realestate/competitive-buyers-waive-contingencies-to-score-homes-in-tight-market/2021/06/02/d335b050-af2c-11eb-b476-c3b287e52a01_story.html

Contact the Martin Group

*Required