*2024 Real Estate Market Reports Palm Beach County Florida

Palm Beach County Market Reports’ Summary of Single Family Homes and Condos in this month 2024 with Stats and SOLD Housing Trends. Buying or Selling, Text/ Call 561-339-1779 to set-up FREE Consultation.

Annual Real Estate Market Report Palm Beach County Florida

Single Family Homes and Condos in Palm Beach County Summary Reports Year-end Annual 2022 with Stats and SOLD Housing Trends. Buying or Selling, Text/ Call 561-339-1779 to set-up FREE Consultation.

Florida Tool Time Sales Tax Holiday September 2022

Florida’s tool time sales tax holiday begins September 2, 2023, which means shoppers won’t pay sales tax on most of the things found on the tool time list! The Tool Time Sales Tax Holiday ends September 8, 2023.

8 Strategies to Secure Lower Mortgage Rate

8 Strategies to Secure a Lower Mortgage Rate This year, mortgage rates have been on a roller coaster ride, rising and falling amid inflationary pressures and economic uncertainty. Even the experts are divided about where rates are headed next1 when it comes to predictions. There is hope for you in that you might get a lower mortgage rate. This climate has been unsettling for some homebuyers and sellers. However, with proper planning, you can work toward qualifying for the best mortgage rates available today – and open up the possibility of refinancing at a lower mortgage rate in the future. How does a lower mortgage rate save you money? According to Trading Economics, the average new mortgage size in the United States is currently around $410,000.2 Let’s compare a 5.0% versus a 6.0% fixed interest rate on that amount over a 30-year term. Mortgage Rate (30-year fixed) Monthly Payment on $410,000 Loan(excludes taxes, insurance, etc.) Difference in Monthly Payment Total Interest Over 30 Years Difference in Interest 5.0% $2,200.97 $382,348.72 6.0% $2,458.16 + $257.19 $474,936.58 + $92,587.86 With a 5% rate, your monthly payments would be about $2,201. At 6%, those payments would jump to $2,458, or around $257 more. That adds up to a difference of almost $92,600 over the lifetime of the loan. In other words, shaving off just one percentage point on your mortgage could put nearly $100K in your pocket over time. Therefore, how can you improve your chances of securing a low mortgage rate? Try these eight strategies: 1. Raise your credit score. Borrowers with higher credit scores are viewed as “less risky” to lenders, so they are offered lower interest rates. A good credit score typically starts at 690 and can move up into the 800s.3 If you don’t know your score, check with your bank or credit card company to see if they offer free access. If not, there are a plethora of both free and paid credit monitoring services you can utilize. If your credit score is low, you can take steps to improve it, including:4 Correct any errors on your credit reports, which can bring down your score. You can access reports for free by visiting AnnualCreditReport.com. Pay down revolving debt. This includes credit card balances and home equity lines of credit. Avoid closing old credit card accounts in good standing. It could lower your score by shortening your credit history and shrinking your total available credit. Make all future payments on time. Payment history is a primary factor in determining your credit score, so make it a priority. Limit your credit applications to avoid having your score dinged by too many inquiries. If you’re shopping around for a car loan or mortgage, minimize the impact by limiting your applications to a short period, usually 14 to 45 days.5 Over time, you should start to see your credit score climb — which will help you qualify for a lower mortgage rate. 2. Keep steady employment. If you are preparing to purchase a home, it might not be the best time to make a major career change. Unfortunately, frequent job moves or gaps in your résumé could hurt your borrower eligibility. When you apply for a mortgage, lenders will typically review your employment and income over the past 24 months.5 If you’ve earned a steady paycheck, you could qualify for a better interest rate. A stable employment history gives lenders more confidence in your ability to repay the loan. That doesn’t mean a job change will automatically disqualify you from purchasing a home. But certain moves, like switching from W-2 to 1099 (independent contractor) income, could throw a wrench in your home buying plans.6 3. Lower your debt-to-income ratios. Even with a high credit score and a great job, lenders will be concerned if your debt payments are consuming too much of your income. That’s where your debt-to-income (DTI) ratios will come into play. There are two types of DTI ratios:7 Front-end ratio — What percentage of your gross monthly income will go towards covering housing expenses (mortgage, taxes, insurance, and dues or association fees)? Back-end ratio — What percentage of your gross monthly income will go towards covering ALL debt obligations (housing expenses, credit cards, student loans, and other debt)? What’s considered a good DTI ratio? For better rates, lenders typically want to see a front-end DTI ratio that’s no higher than 28% and a back-end ratio that’s 36% or less.7 If your DTI ratios are higher, you can take steps to lower them, like purchasing a less expensive home or increasing your down payment. Your back-end ratio can also be decreased by paying down your existing debt. A bump in your monthly income will also bring down your DTI ratios. 4. Increase your down payment. Minimum down payment requirements vary by loan type. But, in some cases, you can qualify for a lower mortgage rate if you make a larger down payment.8 Why do lenders care about your down payment size? Because borrowers with significant equity in their homes are less likely to default on their mortgages. That’s why conventional lenders often require borrowers to purchase private mortgage insurance (PMI) if they put down less than 20%. A larger down payment will also lower your overall borrowing costs and decrease your monthly mortgage payment since you’ll be taking out a smaller loan. Just be sure to keep enough cash on hand to cover closing costs, moving expenses, and any furniture or other items you’ll need to get settled into your new space. 5. Compare loan types. All mortgages are not created equal. The loan type you choose could save (or cost) you money depending on your qualifications and circumstances. For example, here are several common loan types available in the U.S. today:9 Conventional — These offer lower mortgage rates but have more stringent credit and down payment requirements than some other types. FHA — Backed

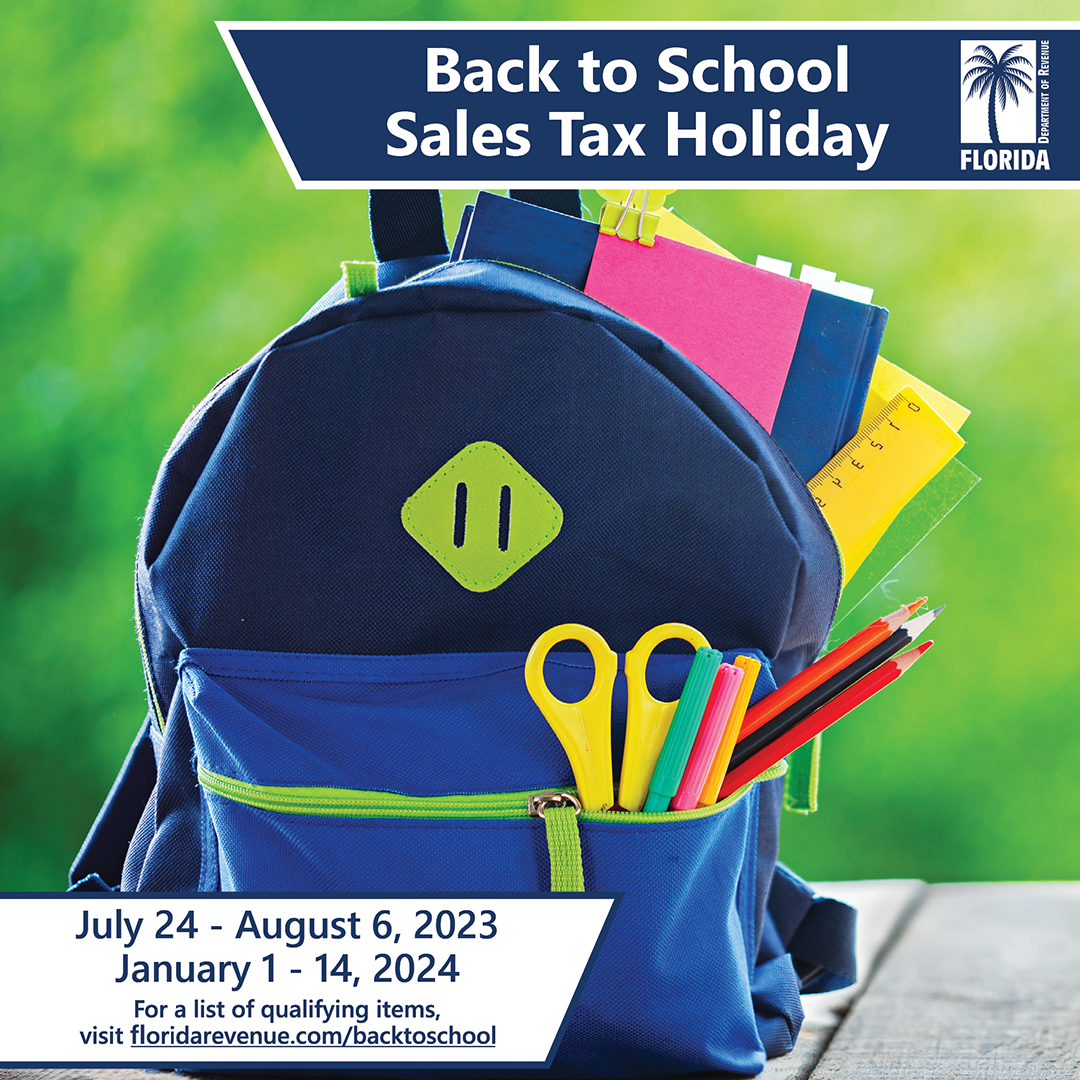

Florida School Sales Tax Holiday for South Florida in July & January 1st – 14th 2024

Florida’s back to school sales tax holiday begins Monday, July 24, 2023, which means shoppers won’t pay sales tax on most of the things found on a student’s supply list! Sales Tax Holiday ends August 6, 2023.

Overcome Inflation With Real Estate Investments

The Top Home Design Trends for 2022 are represented in the above photo. Key words: warm, inviting, minimalist, back to nature, rounded, earth tones, variety of textures. These design trends will be covered in this article.

Higher Rates Short Supply Real Estate 2022

A high offer price gets attention. But most sellers consider a variety of factors when evaluating an offer. With that in mind, here are five tactics you can utilize to sweeten your proposal and outshine your competition.

Write A Winning Real Estate Offer

A high offer price gets attention. But most sellers consider a variety of factors when evaluating an offer. With that in mind, here are five tactics you can utilize to sweeten your proposal and outshine your competition.

Real Estate Market Trends Palm Beaches 2022

What’s the state of housing market in SE Florida 2022? Home prices soared in south Florida by a record 29% between January 2021 – January 2022, a history maker.

Home Buyers: 10 Step Buying Process

Home Buyers: 10 Step Buying Process 1. Save Your Down Payment Many people believe you need a 20% down payment to buy a home. There are loans available that allow buyers to put down as little as 3% or 0% with a VA or USDA Loan. 2. Know Your Credit Score Your credit score is a numeric representation of your history and ability to pay back debts in the past. Different home loans have different credit requirements. Save credit card purchases until after you close on your mortgage… to improve your credit score. 3. Find a Real Estate Agent Once you have a handle on your credit score and down payment savings, the Martin Group 561-339-1779 can guide you through the home buying process. 4. Get Mortgage Pre-Approval We can give you a list of lenders from which you can choose the one you want to work with to get pre-approved for your mortgage loan. This will help keep you on budget during the next step! 5. Go House Shopping Make a list of what you want vs. what you need in your next home. The Martin Group of Realtors® will use this list to find homes for you to tour. We make the appointments for you after your approval of our list. 6. Make an offer Using our 50 years of experience as real estate agents, the Martin Group will help you determine the best price to offer in the current market for the home. In a competitive market, you may net be the only one bidding and will want to stand out! 7. Get a Home Inspection Once your offer is accepted, you will want to have the home inspected professionally to ensure there are not any hidden issues with the home. We can furnish a reliable list of home inspectors. 8. Get a Home Appraisal Your lender will arrange for a home appraisal to ensure that the property is worth the price that you have agreed to pay for it. The bank will only issue a loan for the appraised value. 9. Close the Sale Once your loan is approved, your lender will schedule a closing date. This is the day you sign all your paperwork with a Title Company to complete the purchase and get the keys to your home. 10. Move In Congratulations! You are now the owner of the home! And time to move in. The Martin Group can give you some recommendations for moving companies. This is the beginning of your next phase in life. Enjoy! CONGRATULATIONS! Summary of 10 Step Home Buying Process Ready to Begin the Buying Process? We have many more tips to help you… Let’s Talk! Schedule A FREE Consultation Doug Martin Realtor® Broker 561-339-3299 Email Me