Real Estate Market Reports And Trends:

The Ultimate Palm Beach County, Florida Guide

This article is the ULTIMATE Guide to the Palm Beach County, Florida Market Reports. See monthly housing updates, trends, sold prices, home values, active listings, and neighborhood data to guide your next buying, selling, or investing in real estate.

Text or Call The Martin Group at 561-339-1779 for a FREE real estate consultation for buyers or sellers and to view any property. You can Email us now.

Curious if now’s a good time to sell—or if prices are rising in your area? Each month, we break down the latest real estate stats so you can make confident decisions, whether you’re buying, selling, or staying put.

Stay up-to-date with our monthly Market Reports! Staying up-to-date on Florida’s real estate market trends is essential for making informed decisions when buying, selling, or investing.

The market’s unique seasonal shifts, driven by factors like weather, taxes, interest rates, seasonal changes, and out-of-state buyers, can significantly impact property values and availability.

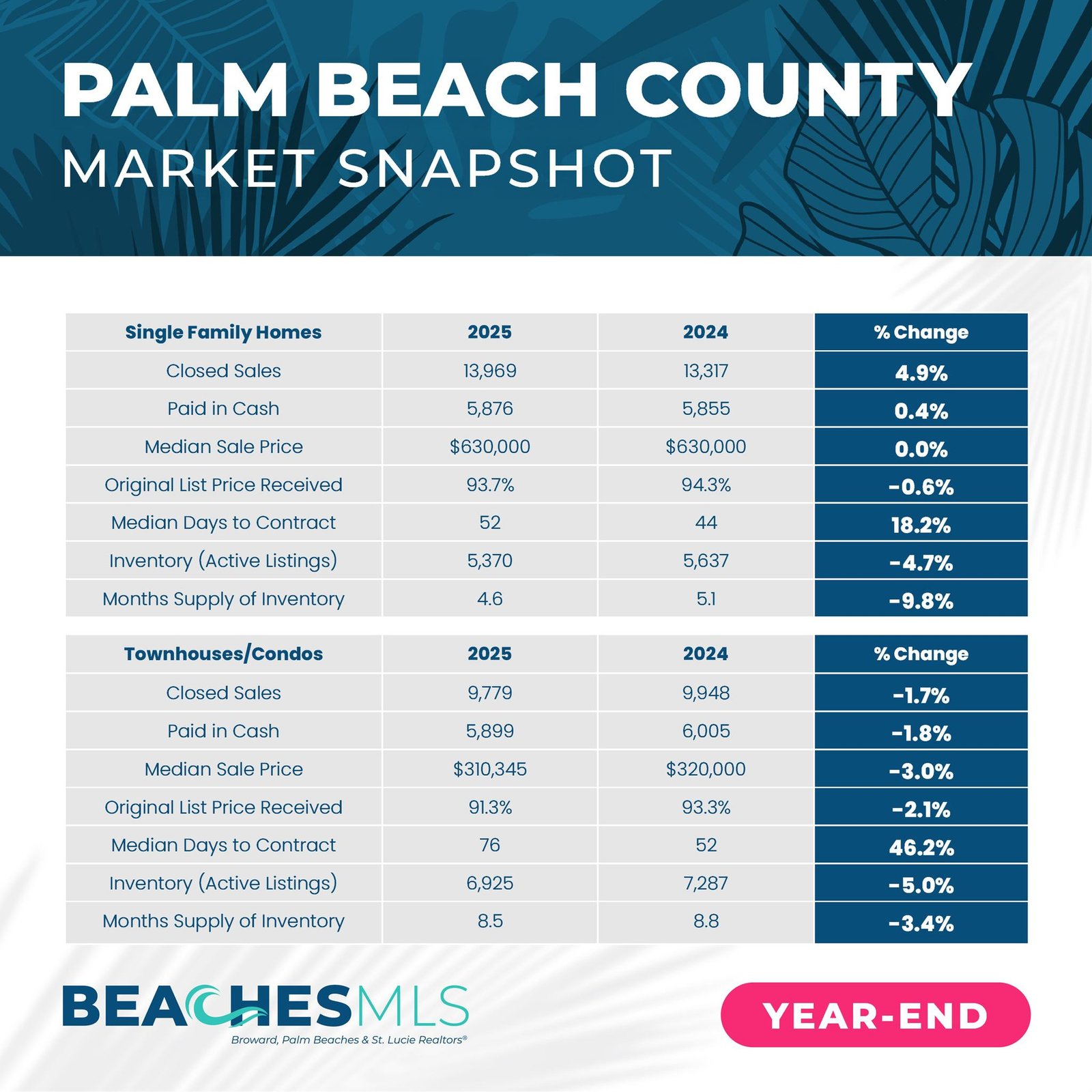

Palm Beach County Real Estate Snapshot Report

Market Report was Released January 16, 2026 with December Year End 2025 Stats

How these reports are made: The BeachesMLS compares the stats from the current year of a specific month with the same month last year. The reports are released about the 3rd week of the each month with the total stats for the previous month.

Summary of the Palm Beach County Snapshot Report

Palm Beach County’s housing market ended 2025 with a strong uptick in activity, highlighting steady buyer demand despite the seasonally slower period. Closed sales jumped 23.0% year-over-year in December, totaling 1,269 single-family home transactions compared to 1,032 in December 2024. New pending sales also rose 13.4% year-over-year to 1,007, pointing to continued momentum as the market moves into the new year.

Inventory levels tightened further, underscoring a competitive environment for well-priced properties. Active listings fell 4.7% year-over-year to 5,370, resulting in a 4.6-month supply of inventory—still below the threshold of a balanced market. Home values remained resilient, with higher-end transactions pushing overall pricing higher. The median sale price edged up 1.6% year-over-year to $632,500, while the average sale price surged 26.9% to $1,353,599.

Video of Housing Market Report January 2025

Includes 4 Coastal Counties In Southeast Florida

Update Released January 16, 2025 with December 2025 Stats6

By BeachesMLS and Realtors® Association of the Palm Beaches.

Understanding these trends helps you time your transactions for maximum advantage—whether buying in the off-season for better prices or selling during peak demand. Having the knowledge of real estate market dynamics empowers you to make strategic, well-timed moves that can lead to financial success.

For investors, being aware of the latest trends enables you to identify profitable opportunities, from vacation rentals to long-term properties.

Text or call The Martin Group at 561-339-3299 or Email us and schedule a FREE Consultation.

Homes Are Selling at Record Highs... Up 11%-29% !

Find Out If Your Home’s Value Has Increased.

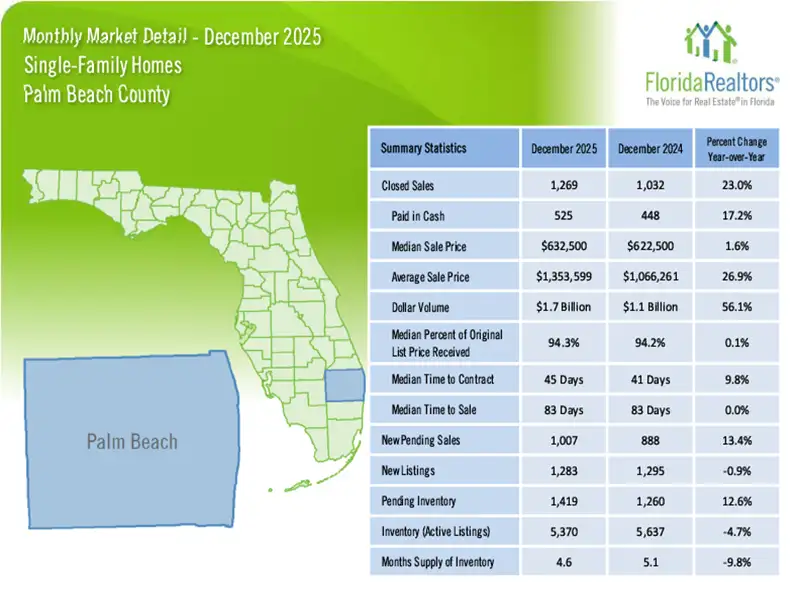

Single Family Homes Market Report

Palm Beach County, Florida

Market Report Released January 16, 2026 with December, 2025 Stats

The above table provides a detailed analysis of the residential single family real estate/ housing market in Palm Beach County, Florida for the January 16, 2026 Report with December, 2025 Stats that highlights key statistics and trends.

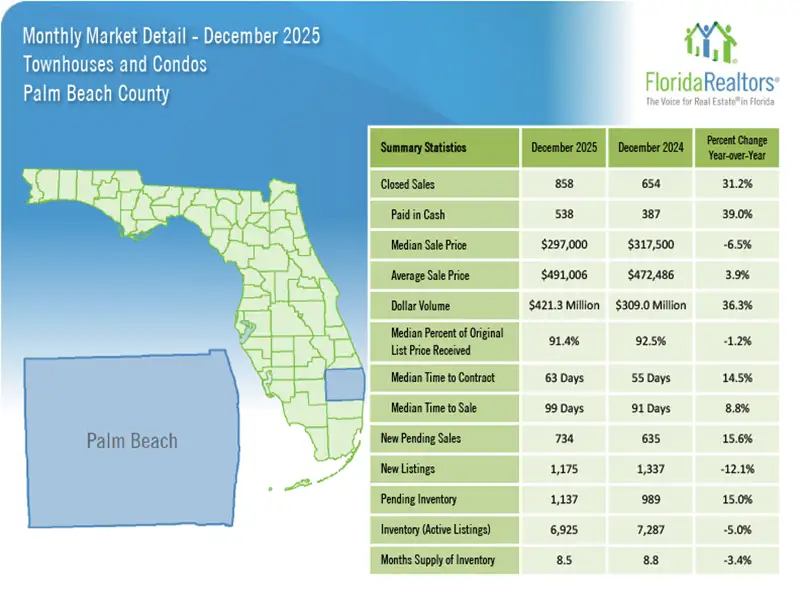

Condos Townhouses Market Report

Palm Beach County, Florida

Released January 16, 2026 with December 2025 Stats

The above table provides a detailed analysis of the residential condos/ townhouses in the real estate/ housing market in Palm Beach County, Florida for the January 16, 2026 Report with December 2025 Stats that highlights key statistics and trends.

Thinking about buying, or selling real estate in 2025?

Text or call for a free consultation:

Video Of Housing Market Report for Whole State of Florida

Released January 16, 2026 With December, 2025 Stats

Video by Florida Realtors® Association

After a long stretch of adjustment, Florida’s housing market appears to be cooling off slightly at the beginning of this new year. With buyer demand improving and stability returning to prices, the outlook is looking brighter heading into winter and spring.

You might like to read: Why Florida Interest Rates Matter Now

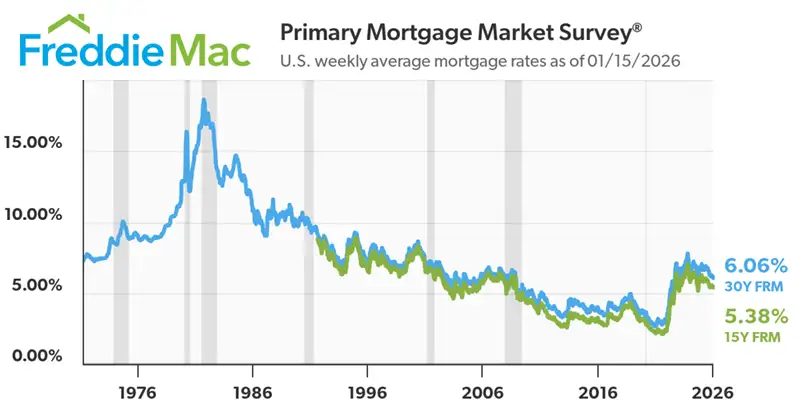

Freddie Mac 30 Year Average Historical Mortgage Rates

On January 15, 2026, Average Mortgage Rate was down from previous month.

Plus it was the lowest mortgage rate since 2022. Good news for home buyers!

Chart is based on a 30Y FRM = 30 Year Fixed Rate Mortgage

Lowest Mortgage Rate was 2.65% on Jan 6, 2021

Highest Mortgage Rate was 18.63% on October 8, 1981

To view the latest update on mortgage rates, plus interact with 30 year chart,

go to: Freddie Mac Primary Mortgage Rates.

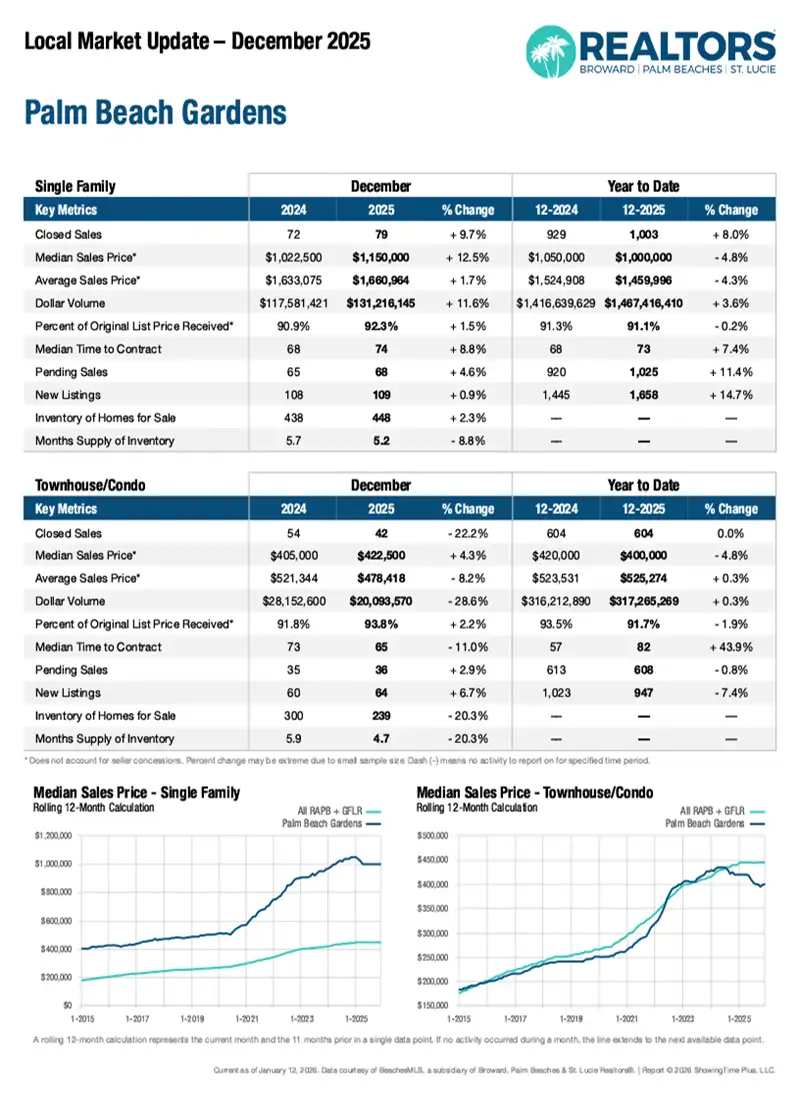

Palm Beach Gardens, Florida Market Report

Released January 16, 2026 with December, 2025 Stats

(This is an example of a Monthly City Market Report.)

Palm Beach Gardens, Florida Market Action Index

Slight Seller's Market

This week the median list price for Palm Beach Gardens, FL is $1,399,944 with the market action index hovering around 31. This is less than last month’s market action index of 32. Inventory has decreased to 348.

Market conditions have been consistently cooling in the past several weeks. Because we’re still in the Seller’s zone, prices have not yet begun to drop. It may take a few more weeks of slack demand for prices to reflect and begin to fall. Expect prices to fall if the index persistently falls to the Buyer’s zone.

Source: Michael Lewis Marketing and Altos Research.

Update Released November 20, 2025 with November 20, 2025 Stats

Want To Find Your Dream Home Now?

Insert Your Criteria For a Quick Search of South Florida Homes & Condos

Call or text the Martin Group to learn more: 561-339-1779 or Email The Martin Group.

Contact The Martin Group of Realtors®

Let’s Chat!

Jason Martin & Doug Martin

Premier Brokers International

LOCAL EXPERTISE • GLOBAL REACH

50+ years of experience as Realtors® and Custom Home Builders.

Helping you reach your real estate goals!

Jason Martin, PA

Residential Realtor® Agent

561-624-4544

Email Me

Doug Martin

Broker Realtor® Emeritus

561-339-3299

Email Me