Home Sellers: How to Get the Highest Price For My Home

In this article are some tips to get the highest price when selling your home. It is all about preparation, pricing, and promotion to get the top dollar for your home.

Annual Real Estate Market Report Palm Beach County Florida

Single Family Homes and Condos in Palm Beach County Summary Reports Year-end Annual 2022 with Stats and SOLD Housing Trends. Buying or Selling, Text/ Call 561-339-1779 to set-up FREE Consultation.

Sellers: How to Get Highest Price For My Home

In this article are some tips to get the highest price when selling your home. It is all about preparation, pricing, and promotion to get the top dollar for your home.

Annual Vs Seasonal Rentals What’s the Difference?

Are you thinking about renting a house or condo, but you’re not sure whether you want an annual rental, a seasonal rental, or just a short vacation rental? There are pros and cons to all types of leases.

Real Estate CMA: Comparative Market Analysis

Know the factors that affect market or home value which are different from assessed value, which is often lower than the market value. Martin Group can help you with both numbers. Text or Call at 561-3391-779 to schedule your free consultation.

Florida Tool Time Sales Tax Holiday September 2022

Florida’s tool time sales tax holiday begins September 2, 2023, which means shoppers won’t pay sales tax on most of the things found on the tool time list! The Tool Time Sales Tax Holiday ends September 8, 2023.

8 Strategies to Secure Lower Mortgage Rate

8 Strategies to Secure a Lower Mortgage Rate This year, mortgage rates have been on a roller coaster ride, rising and falling amid inflationary pressures and economic uncertainty. Even the experts are divided about where rates are headed next1 when it comes to predictions. There is hope for you in that you might get a lower mortgage rate. This climate has been unsettling for some homebuyers and sellers. However, with proper planning, you can work toward qualifying for the best mortgage rates available today – and open up the possibility of refinancing at a lower mortgage rate in the future. How does a lower mortgage rate save you money? According to Trading Economics, the average new mortgage size in the United States is currently around $410,000.2 Let’s compare a 5.0% versus a 6.0% fixed interest rate on that amount over a 30-year term. Mortgage Rate (30-year fixed) Monthly Payment on $410,000 Loan(excludes taxes, insurance, etc.) Difference in Monthly Payment Total Interest Over 30 Years Difference in Interest 5.0% $2,200.97 $382,348.72 6.0% $2,458.16 + $257.19 $474,936.58 + $92,587.86 With a 5% rate, your monthly payments would be about $2,201. At 6%, those payments would jump to $2,458, or around $257 more. That adds up to a difference of almost $92,600 over the lifetime of the loan. In other words, shaving off just one percentage point on your mortgage could put nearly $100K in your pocket over time. Therefore, how can you improve your chances of securing a low mortgage rate? Try these eight strategies: 1. Raise your credit score. Borrowers with higher credit scores are viewed as “less risky” to lenders, so they are offered lower interest rates. A good credit score typically starts at 690 and can move up into the 800s.3 If you don’t know your score, check with your bank or credit card company to see if they offer free access. If not, there are a plethora of both free and paid credit monitoring services you can utilize. If your credit score is low, you can take steps to improve it, including:4 Correct any errors on your credit reports, which can bring down your score. You can access reports for free by visiting AnnualCreditReport.com. Pay down revolving debt. This includes credit card balances and home equity lines of credit. Avoid closing old credit card accounts in good standing. It could lower your score by shortening your credit history and shrinking your total available credit. Make all future payments on time. Payment history is a primary factor in determining your credit score, so make it a priority. Limit your credit applications to avoid having your score dinged by too many inquiries. If you’re shopping around for a car loan or mortgage, minimize the impact by limiting your applications to a short period, usually 14 to 45 days.5 Over time, you should start to see your credit score climb — which will help you qualify for a lower mortgage rate. 2. Keep steady employment. If you are preparing to purchase a home, it might not be the best time to make a major career change. Unfortunately, frequent job moves or gaps in your résumé could hurt your borrower eligibility. When you apply for a mortgage, lenders will typically review your employment and income over the past 24 months.5 If you’ve earned a steady paycheck, you could qualify for a better interest rate. A stable employment history gives lenders more confidence in your ability to repay the loan. That doesn’t mean a job change will automatically disqualify you from purchasing a home. But certain moves, like switching from W-2 to 1099 (independent contractor) income, could throw a wrench in your home buying plans.6 3. Lower your debt-to-income ratios. Even with a high credit score and a great job, lenders will be concerned if your debt payments are consuming too much of your income. That’s where your debt-to-income (DTI) ratios will come into play. There are two types of DTI ratios:7 Front-end ratio — What percentage of your gross monthly income will go towards covering housing expenses (mortgage, taxes, insurance, and dues or association fees)? Back-end ratio — What percentage of your gross monthly income will go towards covering ALL debt obligations (housing expenses, credit cards, student loans, and other debt)? What’s considered a good DTI ratio? For better rates, lenders typically want to see a front-end DTI ratio that’s no higher than 28% and a back-end ratio that’s 36% or less.7 If your DTI ratios are higher, you can take steps to lower them, like purchasing a less expensive home or increasing your down payment. Your back-end ratio can also be decreased by paying down your existing debt. A bump in your monthly income will also bring down your DTI ratios. 4. Increase your down payment. Minimum down payment requirements vary by loan type. But, in some cases, you can qualify for a lower mortgage rate if you make a larger down payment.8 Why do lenders care about your down payment size? Because borrowers with significant equity in their homes are less likely to default on their mortgages. That’s why conventional lenders often require borrowers to purchase private mortgage insurance (PMI) if they put down less than 20%. A larger down payment will also lower your overall borrowing costs and decrease your monthly mortgage payment since you’ll be taking out a smaller loan. Just be sure to keep enough cash on hand to cover closing costs, moving expenses, and any furniture or other items you’ll need to get settled into your new space. 5. Compare loan types. All mortgages are not created equal. The loan type you choose could save (or cost) you money depending on your qualifications and circumstances. For example, here are several common loan types available in the U.S. today:9 Conventional — These offer lower mortgage rates but have more stringent credit and down payment requirements than some other types. FHA — Backed

Discover Flavor Palm Beach September Event

Discover Flavor Palm Beach September Event Flavor Palm Beach is a month-long dining event, September 1 – 30, 2022, and was started in 2007 to introduce diners to the vast array of restaurants throughout Palm Beach County. To participate in Flavor Palm Beach, no tickets or passes are required. Simply make a reservation, visit the restaurant, and enjoy the food. You will experience menus that define the art of dining in The Palm Beaches, dishes found nowhere else. For an entire month, restaurants and bistros offer prix fixe [a meal consisting of several courses served at a total fixed price] menus for lunch and dinner to tempt you to taste the local cuisine from Jupiter to Boca Raton. Choose from the best restaurants and enjoy three-course lunches or dinners. Here’s your opportunity to try restaurants you’ve heard so much about – without breaking the bank. Plus any evening in September would make a great date night. With more than 60 restaurants, September is your month to discover the many flavors of The Palm Beaches. Flavor Palm Beach is a great time to savor the dining and culinary delights found throughout The Palm Beaches. From farm-fresh, organic, or sustainable to surf-and-turf or burgers and fries, the dining scene is savory and delicious variety. The restaurants participating in Flavor Palm Beach will satisfy your gourmet food cravings. Each restaurant has different entrees and a unique atmosphere from the others. Scroll through the menus of participating restaurants below and choose your favorite FLAVOR! Flavor Palm Beach – Participating Restaurants Includes Address, Phone Number, Lunch & Dinner Menus We highly recommend trying new restaurants this month during Flavor Palm Beach. Check out what others say about dining in The Palm Beaches. For more information, visit flavorpb.com. 2022 FLAVOR Palm Beach Restaurant List Palm Beach County September 1-30, 2022 2022 Flavor Palm Beach Official Logo COASTAL AMERICAN 3800 OCEAN, Singer Island AMBASSADOR GRILL, Palm Beach AQUA GRILLE, Juno Beach BLUE POINTE BAR AND GRILL, Tequesta BRANDON’S AT TIDELINE, Palm Beach BREEZE AT THE EAU, Palm Beach COOL’A FISH BAR, Palm Beach Gardens FIREFIN GRILL, Palm Beach Gardens FLORIE’S AT FOUR SEASONS, Palm Beach KEE GRILL, Juno Beach SEAWAY AT FOUR SEASONS, Palm Beach SEMINOLE REEF GRILL, North Palm Beach THE ATLANTIC GRILLE, Delray Beach TOMMY BAHAMA, Jupiter TWISTED TUNA, Jupiter MODERN AMERICAN ANGLE AT THE EAU, Palm Beach BARCELLO, North Palm Beach BRICK AND BARREL, Jupiter CAFE CHARDONNAY, Palm Beach Gardens CROSBY KITCHEN AND BAR, Jupiter FERN STREET, West Palm Beach GALLEY, West Palm Beach HONEYBELLE, Palm Beach Gardens JOSCO BAR AND OVEN, Tequesta PADDY MAC’S, Palm Beach Gardens PAVILLION GRILLE, Boca Raton RED LIGHT, West Palm Beach SEASONS 52, Palm Beach Gardens STADIUM GRILL, Jupiter TABLE 26, West Palm Beach THE WOODS, Jupiter SASSAFRAS, West Palm Beach THE SOSO, West Palm Beach ITALIAN AND GREEK CAFE CENTRO, West Palm Beach CASA MIA, Jupiter CUCINA CABANA, North Palm Beach EVO ITALIAN, Tequesta GRATO, West Palm Beach LA MASSERIA, Palm Beach Gardens LIMONCELLO, North Palm Beach POLPO AT THE EAU, Palm Beach SALUTE MARKET, Palm Beach Gardens TAVERN PI, Jupiter MANA GREEK FUSION, Jupiter FRENCH ALMOND PALM BEACH, Palm Beach CAFE BOULUD, Palm Beach CHEZ MARIE BISTRO, Boca Raton LA GOULUE, Palm Beach THE PARISIAN, Jupiter STEAK AND SEAFOOD AVALON STEAK AND SEAFOOD, Delray Beach RAINDANCER STEAKHOUSE, West Palm Beach RUTH’S CHRIS, Boca Raton RUTH’S CHRIS, West Palm Beach THE BUTCHER’S CLUB, Palm Beach Gardens WARREN, Delray Beach ASIAN INSPIRED KAPOW NOODLE BAR, West Palm Beach KAPOW NOODLE BAR, Boca Raton LATIN-INSPIRED CASA CANA, Tequesta CALAVERAS CANTINA, Jupiter SPECIALTY MELTING POT, Boca Raton MELTING POT, Palm Beach Gardens PADDY MACS, Palm Beach Gardens PLANTA, West Palm Beach WYNDHAM LOBBY BAR, Jupiter Now… to Real Estate in Palm Beach County Search Condos & Homes For Sale in SE Florida Ready to Buy, Sell, Rent, or Invest in Real Estate? Get tips from 40+ years of experience as Realtors® and Custom Home Builders. Let’s chat…. coffee on us! Schedule a FREE Consultation Doug Martin Realtor® Emeritus Broker 561-339-3299 Email Me Featured Articles Blog Posts Browse All Posts

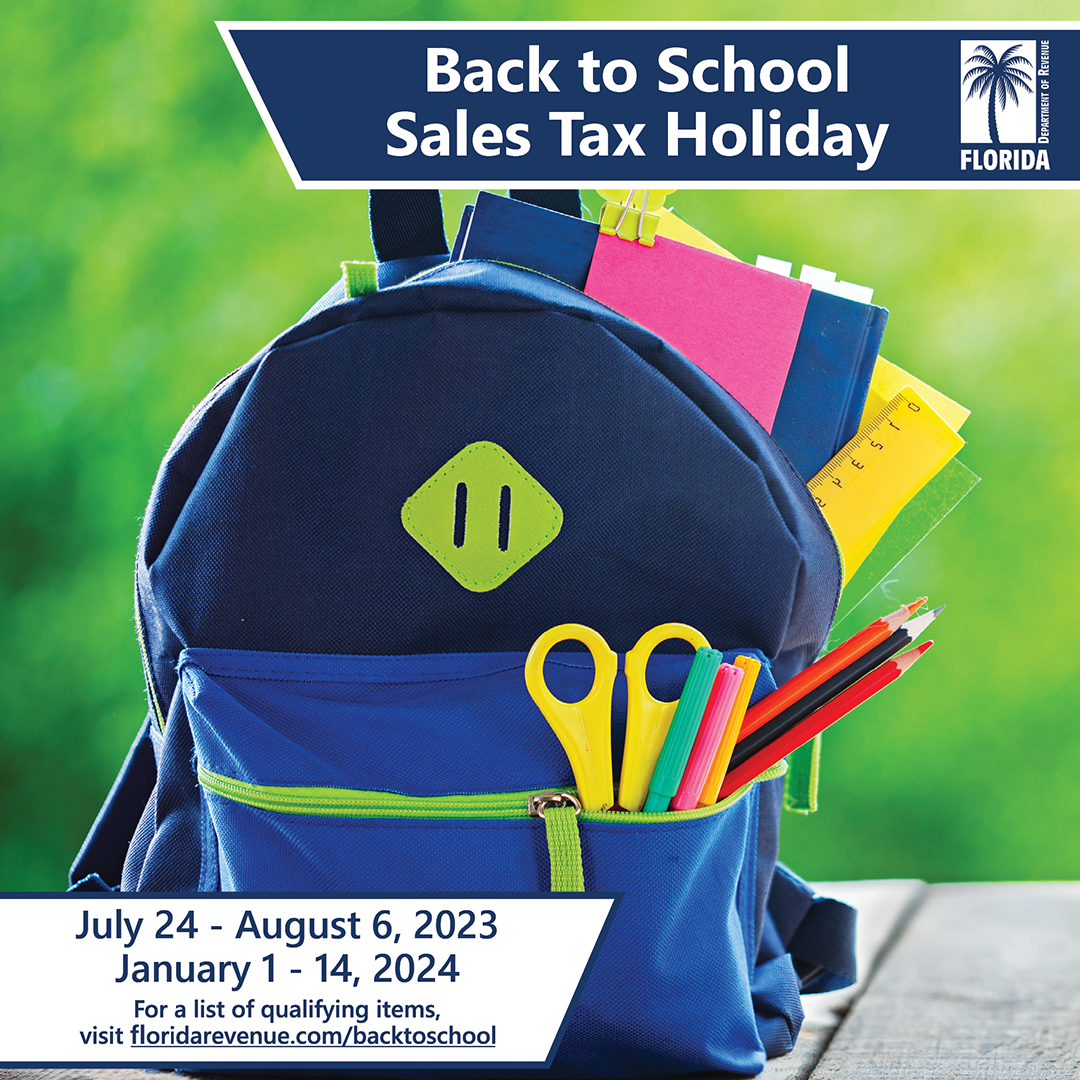

Florida School Sales Tax Holiday for South Florida in July & January 1st – 14th 2024

Florida’s back to school sales tax holiday begins Monday, July 24, 2023, which means shoppers won’t pay sales tax on most of the things found on a student’s supply list! Sales Tax Holiday ends August 6, 2023.

Home Sellers: Avoid These 7 Costly Mistakes

Whatever your circumstances, the road to the closing table can be riddled with obstacles — from issues with showings and negotiations to inspection surprises. But many of these complications are avoidable.