Buy Now or Rent Longer in 2026? 5 Smart Questions for First-Time Home Buyers

BUY NOW OR RENT LONGER IN 2026?

5 Smart Questions For First Home Buyers

6 Facing the buy or rent dilemma in today’s housing market? Discover the five essential questions every first-time homebuyer should ask in 2026 to decide whether purchasing or renting makes sense — with up-to-date tips and actionable steps.

Deciding whether to jump into the housing market or rent instead is rarely an easy decision — especially if you’re a first-time homebuyer. But in today’s whirlwind market, you may find it particularly challenging to pinpoint the best time to start exploring homeownership.

A real estate boom during the pandemic pushed home prices to all-time highs. Add higher mortgage rates to the mix, and some would-be buyers are wondering if they should wait to see if prices or rates come down.

But is renting a better alternative? Rents have also seen fluctuations and shifts in trend. According to data, in June 2025 renting a starter home saved an average of $908 per month compared to buying in 49 out of the 50 largest U.S. metros. (Realtor) Meanwhile, studies show that in 2026 the cost of owning is on average still higher than renting across most U.S. metros. (Bankrate+1)

So, what’s the better choice for you? There’s a lot to consider when it comes to buying versus renting. Luckily, you don’t have to do it alone. Reach out to schedule a free consultation and we’ll help walk you through your options.

You may also find it helpful to ask yourself the following questions:

1. How Long Do I Plan to Stay in the Home?

You’ll generally get more financial benefit from a home purchase if you own the property for several years. Many past guides suggested five years; even in 2026 many analysts suggest a longer horizon given market conditions. (Wini+1)

If you plan to sell in a shorter period of time, a home purchase may not be the best choice for you. There are costs associated with buying and selling a home, and it may take time for the property’s value to rise enough to offset those expenditures.

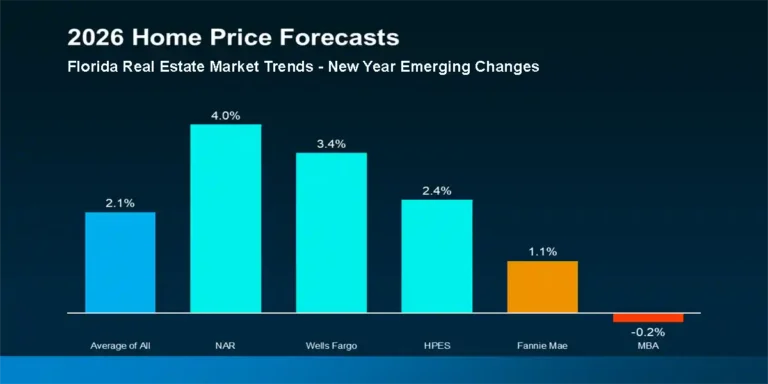

Even though housing markets can shift from one year to the next, you’ll typically find that a home’s value will ride out ups and downs and appreciate with time—but given today’s slower growth projections (3% or less in 2026) that appreciation may be more modest than past decades. (JPMorgan Chase)

The longer you own a property, the more you are likely to benefit from its appreciation.

Once you’ve found a community that you’d like to stay in for several years, then buying over renting can really pay off. You’ll not only benefit from appreciation, but you’ll also build equity as you pay down your mortgage — and you’ll have more stability overall.

Also important: If you plan to stay in the home for the life of the mortgage, there will come a time when you no longer have to make mortgage payments. As a result, your housing costs will drop dramatically, while your equity (and net worth) continue to grow.

Buying Could Be the Best Long-Term Investment.

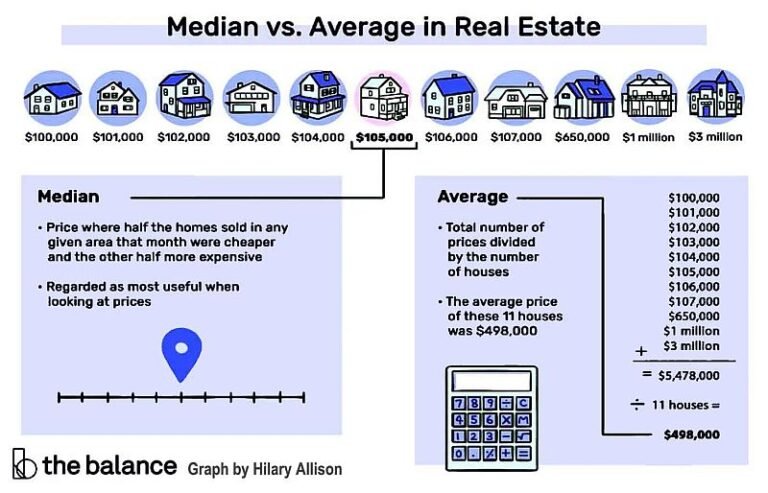

2. Is it a Better Value to Buy or Rent in my Area?

If you know you plan to stay put for at least five years (or longer), you should consider whether buying or renting is the better bargain in your area.

One helpful tool for evaluating your options is a neighborhood’s price-to-rent ratio: divide median home price by median yearly rent. A higher ratio suggests buying is relatively more expensive versus renting. But in 2026, this equation needs extra context: in many U.S. metros the monthly cost of owning exceeds renting by a wide margin. (SmartAsset+1)

According to one 2025 study, only about 32 out of 343 U.S. cities (in a 300+ city sample) are more affordable to buy than rent. Details of “buy vs. rent” in many cities at Construction Coverage

Other data indicates the income required to afford homeownership remains much higher than renting. In February 2025, the typical homebuyer needed an annual income of ~US$117,000—82% more than what is required for typical rental housing (~US$64,000). (Redfin)

So even if renting seems like a better deal today, buying could still be the better long-term financial play—but only if the numbers in your specific area support it.

Ready to compare your options? Then reach out to schedule a free consultation. As local market experts, we can help you interpret the numbers for your neighborhood.

3. Can I Afford to Be a Homeowner?

If you determine that buying a home is the better value, you’ll want to evaluate your financial readiness.

Start by examining how much you have in savings. After committing a down payment and closing costs, will you still have enough money left over for emergencies and maintenance? If not, that’s a sign you may be better off waiting until you’ve built a larger rainy-day fund.

Then consider how your monthly budget will be impacted. Remember: your monthly mortgage payment won’t be your only expense going forward. You may also need to factor in property taxes, insurance, homeowners association (HOA) fees, maintenance, and repairs.

Still, you could find that the monthly cost of homeownership is comparable to renting—especially with a sizable down payment. Landlords often pass the extra costs of homeowning onto tenants, so renting is not automatically the cheaper option.

Plus, even though you’ll be in charge of upkeep if you buy, you’ll also be the one who stands to benefit from the fruits of your investment. Every major upgrade not only makes your home nicer to live in; it also helps boost the home’s market value.

If you want to buy a home but aren’t sure you can afford it, give us a call to discuss your goals and budget. We can give you a realistic assessment of your options and help you determine if homeownership is within reach.

4. Can I Qualify for a Mortgage?

If you’re prepared to handle the costs, the next step is: how likely are you to get approved for a mortgage?

Every lender will have its own criteria. But in general, you can expect a creditor to scrutinize:

Your job stability and income history (self-employed borrowers often face more documentation)

Your savings and assets

Your credit history and score (higher scores typically get better rates)

Your debt-to-income ratio (how much of your income goes to debt payments)

Whatever your circumstances, it’s always a good idea to get pre-approved before you start house hunting. Let us know if you’re interested, and we’ll give you a referral to reliable loan officers or mortgage brokers.

Want to learn more about applying for a mortgage? Read our blog: “8 Strategies to Secure a Lower Mortgage Rate.”

5. How Would Owning a Home Change My Life?

Before you begin the pre-approval process, it’s important to consider how homeownership affects your life beyond the numbers.

In general, you should be prepared to invest more time and energy in owning a home than you do renting. There can be a fair amount of upkeep involved — especially if you buy a fixer-upper or overcommit to DIY projects. If you’ve only ever lived in an apartment, you might be surprised by how much effort goes into items like lawn care, roof maintenance, exterior painting, etc.

On the other hand, you might relish the chance to build a garden, make personalized upgrades, host family gatherings, build equity, and shape a home that fits you. The great thing about owning a home is you generally have the freedom to do what you want with it — paint walls bold colors, install tech upgrades, or accommodate a growing household.

The choice — like the home — is all yours.

The decision to buy or rent a home is among the most consequential you will make in your lifetime. We can make the process easier by helping you compare your options using real-time local market data.

So don’t hesitate to reach out for a personalized consultation, regardless of where you are in your deliberations. We’d be happy to answer your questions and identify actionable steps you can take now to reach your long-term goals.

The above references are opinions and are for informational purposes only. This is not intended to be financial, legal, or tax advice. Consult the appropriate professionals for guidance regarding your individual needs.

Sources

“Renting vs. Owning Home in 2025: Costs, Benefits & Break-Even Guide.” Wini. 2025. Wini

“Rent vs. Buy: How Housing Costs Compare Across America — 2025 Study.” SmartAsset. 2025.

“Study: Renting is increasingly more affordable than buying.” Bankrate. 2025. Bankrate

“What experts are forecasting for renters and homebuyers this year.” PBS NewsHour. Feb 2025. PBS

“The Rent vs. Buy Gap Intensifies Across America.” Zoocasa. 2025. Zoocasa.com

“Homebuyers Need to Earn Over $50,000 More Than Renters.” Redfin. 2025. Redfin

“2025 housing market: Is it a good time to buy a house?” Yahoo Finance. 2025. Yahoo Finance

“Rent or Buy in 2025: Which Is Smarter for Your Wallet?” reAlpha. 2025.