The Home Loan Process

Covered in this home loan article:

Going through the home loan process can be overwhelming at times. The Martin Group can help guide you through the Mortgage Pre-Approval and Procurement Process.

We have some Mortgage Lender names, if you need them.

Text or call 561-339-1779 for more info.

Most Common Types of Mortgages

• Fixed Rate Mortgages

A fixed-rate mortgage means your mortgage interest rate – and your total monthly payment of principal and interest – will stay the same for the entire term of the loan. This offers you consistency that can help make it easier for you to set a budget.

• Adjustable Rate Mortgage (ARM)

Adjustable-rate mortgages (ARMs) have an interest rate that may change periodically depending on changes in a corresponding financial index that’s associated with the loan. Generally speaking, your monthly payment will increase or decrease if the index rate goes up or down.

• Alternative Mortgage Options

Some eligible home buyers may qualify for an FHA (Federal Housing Administration) or a VA (Department of Veterans Affairs) loan. These loans tend to allow a lower down payment and credit score when compared to conventional loans.

BEFORE Viewing Homes: GET Your Pre-Approval Letter

What You’ll Need to Request a Pre-approval Meeting with Lender

- Contact info for you and all co-applicants

- General loan details such as general amount and property type

- Your Social Security number for customizing your rates

Buyer’s Guide To Mortgage Loan Preparation

Don’t wait until you’re ready to move to start preparing financially to buy a home and secure a mortgage loan. If you are like the vast majority of home buyers, you will choose to finance your purchase with a mortgage loan. By preparing in advance, you can avoid the common delays and roadblocks many buyers face when applying for a mortgage.

The requirements to secure a mortgage may seem overwhelming, especially if you’re a first-time buyer. But we’ve outlined three simple steps to get you started on your path to home ownership.

Even if you’re a current homeowner, it’s a good idea to prepare in advance so you don’t encounter any surprises along the way.

Lending requirements have become more rigorous in recent years, and changes to your credit history, debt levels, job type and other factors could impact your chances of approval.

It’s never too early to start preparing to buy a home.

Follow the following steps to begin laying the foundation for your future home purchase… start today!

STEP 1: CHECK YOUR CREDIT SCORE

Your credit score is one of the first things a lender will check to see if you qualify for a loan.

It’s a good idea to review your credit report and score yourself before applying for a mortgage.

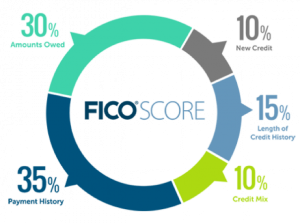

If you have a low score, you will need time to raise it. Most Lenders use your FICO score.

Source: myFico.com

Minimum Score Requirements

To qualify for the lowest interest rates available, you will usually need a FICO score of 760 or higher.

Most lenders require a score of at least 620 to qualify for a conventional mortgage.3

If your FICO score is less than 620, you may be able to qualify for a non-conventional mortgage. However, you should expect to pay higher interest rates and fees.

For example, you may be able to secure an FHA loan (one issued by a private lender but insured by the Federal Housing Administration) with a credit score as low as 580, if you can make a 3.5 percent down payment.

FHA loans are available to applicants with credit scores as low as 500 with a 10 percent down payment.4

Increase Your Credit Score

There’s no quick fix for a low credit score, but the following steps will help you increase it over time.5

Make Payments on Time

At 35 percent, your payment history accounts for the largest portion of your credit score.

Therefore, it’s crucial to get caught up on any late payments and make all of your future payments on time.

If you have trouble remembering to pay your bills on time, set up payment reminders through your online banking platform, a free money management tool like Mint, or an app like BillMinder.

Avoid Applying for New Credit

New accounts will lower your average account age, which could negatively impact your length of credit history.

Also, each time you apply for credit, it can result in a small decrease in your credit score.

The exception to this rule? If you don’t have any credit cards—or any credit accounts at all—you should open an account to establish a credit history.

Just be sure to use it responsibly and pay it off in full each month.

If you need to shop for a new credit account, for example a car loan, be sure to complete your loan applications within a short period of time.

FICO attempts to distinguish between a search for a single loan and applications to open several new lines of credit by the window of time during which inquiries occur.

Pay Down Credit Cards

When you pay off your credit cards and other revolving credit, you lower your amounts owed, or credit utilization ratio (ratio of account balances to credit limits).

Some experts recommend starting with your highest-interest debt and paying it off first.

Others suggest paying off your lowest balance first and then rolling that payment into your next-lowest balance to create momentum.

Whichever method you choose, the first step is to make a list of all of your credit card balances and then start tackling them one by one.

Make the minimum payments on all of your cards except one. Pay as much as possible on that card until it’s paid in full, then cross it off your list and move on to the next card.

| Debt | Interest Rate | Total Payoff | Minimum Payment |

|---|---|---|---|

| Credit Card 1 | 12.5% | $460 | $18.40 |

| Credit Card 2 | 18.9% | $1,012 | $40.48 |

| Credit Card 3 | 3.11% | $6,300 | $252 |

Avoid Closing Old Accounts Closing an old account will not remove it from your credit report. In fact, it can hurt your score, as it can raise your credit utilization ratio—since you’ll have less available credit—and decrease your average length of credit history.

Similarly, paying off a collection account will not remove it from your report. It remains on your credit report for seven years, however, the negative impact on your score will decrease over time.

Correct Errors on Your Report Mistakes or fraudulent activity can negatively impact your credit score. That’s why it’s a good idea to check your credit report at least once per year. The Federal Trade Commission has instructions on their website for disputing errors on your report.

While it may seem like a lot of effort to raise your credit score, your hard work will pay off in the long run. Not only will it help you qualify for a mortgage, a high credit score can help you secure a lower interest rate on car loans and credit cards, as well. You may even qualify for lower rates on insurance premiums.6

STEP 2: SAVE-UP FOR DOWN PAYMENT AND CLOSING COSTS

The next step in preparing for your home purchase is to save up for a down payment and closing costs.

Down Payment

When you purchase a home, you typically pay for a portion of it in cash (down payment) and take out a loan to cover the remaining balance (mortgage). Many first-time buyers wonder: How much do I need to save for a down payment? The answer is … it depends.

Generally speaking, the higher your down payment, the more money you will save on interest and fees. For example, you will qualify for a lower interest rate and avoid paying for mortgage insurance if your down payment is at least 20 percent of the property’s purchase price. But what if you can’t afford to put down 20 percent?

On a conventional loan, you will be required to purchase private mortgage insurance (PMI) if your down payment is less than 20 percent. PMI is insurance that compensates your lender if you default on your loan.7

PMI will cost you between 0.3 to 1.5 percent of the overall mortgage amount each year.8 So, on a $100,000 loan, you can expect to pay between $300 and $1500 per year for PMI until your mortgage balance falls below 80 percent of the appraised value.9 For a conventional mortgage with PMI, most lenders will accept a minimum down payment of five percent of the purchase price.7

If a five-percent down payment is still too high, an FHA-insured loan may be an option for you. Because they are guaranteed by the Federal Housing Administration, FHA loans only require a 3.5 percent down payment if your credit score is 580 or higher.7

The downside of getting an FHA loan? You’ll be required to pay an upfront mortgage insurance premium (MIP) of 1.75 percent of the total loan amount, as well as an annual MIP of between 0.80 and 1.05 percent of your loan balance on a 30-year note. There are also certain limitations on the types of loans and properties that qualify.10

There are a variety of other government-sponsored programs created to assist home buyers, as well. For example, veterans and current members of the Armed Forces may qualify for a VA-backed loan requiring a $0 down payment.7 Consult a mortgage lender about what options are available to you.

| TYPE | MINIMUM DOWN | ADDITIONAL FEES |

|---|---|---|

| Conventional Loan | 20% | Qualify for the best rates and no mortgage insurance required |

| Conventional Loan | 5% | Must purchase private mortgage insurance costing 0.3 – 1.5% of mortgage annually |

| FHA Loan | 3.5% | Upfront mortgage insurance premium of 1.75% of loan amount and annual fee of 0.8 – 1.05% |

Current Homeowners

If you’re a current homeowner, you may have equity in your home that you can use toward your down payment on a new home. We can help you estimate your expected return after you sell your current home and pay back your existing mortgage. Contact us for a free evaluation!

Closing Costs

Closing costs should also be factored into your savings plan. These may include loan origination fees, discount points, appraisal fees, title searches, title insurance, surveys and other fees associated with the purchase of your home. Closing costs vary but typically range between two to five percent of the purchase price.11

If you don’t have the funds to pay these outright at closing, you can often add them to your mortgage balance and pay them over time. However, this means you’ll have a higher monthly payment and pay more over the long term because you’ll pay interest on the fees.

STEP 3: ESTIMATE YOUR HOME PURCHASING POWER

Once you have the required credit score, savings for a down payment and a list of all your outstanding debt obligations via your credit report, you can assess whether you are ready and able to purchase a home.

It’s important to have a sense of how much you can reasonably afford—and how much you’ll be able to borrow—to see if home ownership is within reach.

Your debt-to-income (DTI) ratio is one of the main factors mortgage companies use to determine how much they are willing to lend you, and it can help you gauge whether or not your home purchasing goals are realistic given your current financial situation.

Your DTI ratio is essentially a comparison of your housing expenses and other debt versus your income. There are two different DTI ratios that lenders consider:

1. Front-End Ratio

Also called the housing ratio, this is the percentage of your income that would go toward housing expenses each month, including your mortgage payment, private mortgage insurance, property taxes, homeowner’s insurance and association dues.12

To calculate your front-end DTI ratio, a lender will add up your expected housing expenses and divide it by your gross monthly income (income before taxes).

The maximum front-end DTI ratio for most mortgages is 28 percent. For an FHA-backed loan, this ratio must not exceed 31 percent.13

2. Back-End Ratio

The back-end ratio takes into account all of your monthly debt obligations: your expected housing expenses PLUS credit card bills, car payments, child support or alimony, student loans and any other debt that shows up on your credit report.12

To calculate your back-end ratio, a lender will tabulate your expected housing expenses and other monthly debt payments and divide it by your gross monthly income (income before taxes). The maximum back-end DTI ratio for most mortgages is 36 percent. For an FHA-backed loan, this ratio must not exceed 41 percent.13

Home Affordability Calculator

To get a sense of how much home you can afford, visit the National Association of Realtors’ FREE Home Affordability Calculator at https://www.realtor.com/mortgage/tools/affordability-calculator.

This handy tool will help you determine your home purchasing power depending on your location, annual income, monthly debt and down payment.

It also offers a monthly mortgage breakdown that projects what you would pay each month in principal and interest, property taxes, and home insurance.

The Home Affordability Calculator defaults to a back-end DTI ratio of 36 percent. If the monthly cost estimate at that ratio is significantly higher than what you’re currently paying for housing, you need to consider whether or not you can make up the difference each month in your budget.

If not, you may want to lower your target purchase price to a more conservative DTI ratio. The tool enables you to scroll through higher and lower price points to see the impact on your monthly payments so you can identify your ideal price point.

(Note: This tool only provides an estimate of your purchasing power. You will need to secure pre-approval from a mortgage lender to know your true mortgage approval amount and monthly payment projections.)

Can I Afford to Buy My Dream Home?

Once you have a sense of your purchasing power, it’s time to find out which neighborhoods and types of homes you can afford. The best way to determine this is to contact a licensed real estate agent.

We help homeowners like you every day and can send you a comprehensive list of homes within your budget that meet your specific needs and search criteria.

If there are homes within your price range and target neighborhoods that meet your criteria—congratulations! It’s time to begin your home search.

If not, you may need to continue saving up for a larger down payment … or adjust your search parameters to find homes that do fit within your budget. We can help you determine the right course for you.

STEP 4: START LAYING YOUR FINANCIAL FOUNDATION TODAY

It’s never too early to start preparing financially for a home purchase. These three steps will set you on the path toward home ownership… and a secure financial future!

And if you are ready to buy now but don’t have a perfect credit score or a big down payment, don’t get discouraged. There are resources and options available that might make it possible for you to buy a home sooner than you think. We can help.

Want to find out if you’re ready to buy a house?

We’ll help you review your options, connect you with one of our trusted mortgage lenders, and help you determine the ideal time to begin your new home search. Text or call the Martin Group and request a FREE consultation with no obligations:

We’re Here to Help YOU

As local market experts, we can guide you through the ins and outs of our market, and the local issues that are likely to drive home values in your particular neighborhood.

If you have specific questions, or would like more information about where we see real estate headed in our area, please give us a call! We’d love to discuss how issues here at home are likely to impact your desire to buy or a sell a home this year.

If you’re thinking of buying or selling your home, or know someone who is, keep us in mind because we’re happy to help! Text or call the Martin Group at

561-339-1779. Or if you would rather: Send eMail to the Martin Group.

This article references opinions and is for general informational purposes only. It is not intended to be financial advice. Consult a financial professional for advice regarding your individual needs.

Sources:

- Quicken Loans Blog

- Bankrate – Good Credit Score

- Bankrate – FHA Loans

- MyFICO – Improve Your Credit Score

- The Balance

- Bankrate – How Much Down Payment

- Bankrate – Private Mortgage Insurance

- The Balance – Home Loan Pitfalls

- Investopedia

- Bankrate – Debt to Income

- The Lenders Network

Search Condos & Homes in SE Florida

Real Estate Resources

Ready to Buy, Sell, or Rent a Home or Condo?

We have a few tips that will help you. Let’s talk.

Jason Martin

Realtor® Agent

561-624-4544

Email Me